The financial services space is undergoing a seismic shift, propelled by open banking and the adoption of application programming interfaces, which enable third-party payment services and financial service providers to access consumer banking information securely.

Statistics show that the global open banking market was valued at $23.5 billion in 2023 and is projected to grow at a CAGR of 22% and reach $130.2 billion by 2032.

Open banking APIs allows individuals to access their financial information at will and grant permission for its use to third parties, fostering the development of innovative, tailored banking services.

Industry leaders like Citibank, Barclays, and Capital One are at the forefront of this revolution, having opened their APIs to developers.

This has catalyzed the creation of diverse services and features, demonstrating the innovative potential of open banking.

Key Highlights

The Open Banking Solutions Market was valued at $5.5 billion and is forecasted to expand at a CAGR of 16.0% through 2028 and approximated to reach $11.7 billion.

Pioneering banks like BBVA and Monzo have leveraged API platforms to integrate services into property portals and e-commerce sites, dramatically expanding customer touchpoints.

API-driven lending platforms like Kabbage have revolutionized small business lending, reducing loan decision times from weeks to minutes.

According to McKinsey, banks adopting open banking and APIs have seen a 10% increase in revenue from digital channels.

Advanced security measures, including OAuth 2.0 and AES-256 encryption, have secured open banking APIs.

The future of banking APIs points towards embedded finance, with the market value of the embedded finance sector forecasted to reach $730.5 billion by 2032, growing at a CAGR of over 29% from 2023 to 2032.

Open banking APIs are transforming the banking industry by facilitating data sharing and enabling more personalized financial products.

Open banking APIs enable customers to share their account information securely with third-party providers, connecting to a customer’s bank account to provide financial services like money management and initiating payments with customer consent.

The Evolution of Banking APIs: From Functionality to Innovation

Initially, APIs were primarily used for internal operations and basic online banking functions.

However, as consumer demand for personalized and seamless banking solutions grew, the role of APIs expanded significantly.

Today, banking APIs serve as gateways to various financial products and services.

They enable non-bank entities to offer banking services by integrating with established banking systems.

Account Information Service Providers (AISPs) connect to a customer’s bank account to provide financial services such as money management, and they need to comply with multiple requirements to access and use open banking APIs.

This has led to the emergence of Banking-as-a-Service (BaaS) platforms, where banks provide core banking functions via APIs to fintech companies and other third-party providers.

For instance, Green Dot Corporation leverages its banking-as-a-service platform to power banking solutions for companies like Apple, Intuit, and Uber.

This has resulted in innovative products like Apple Cash and Uber’s instant pay feature for drivers, showcasing how financial service providers can utilize banking APIs to offer new and creative financial products.

How Banking APIs Facilitate Connectivity and Integration

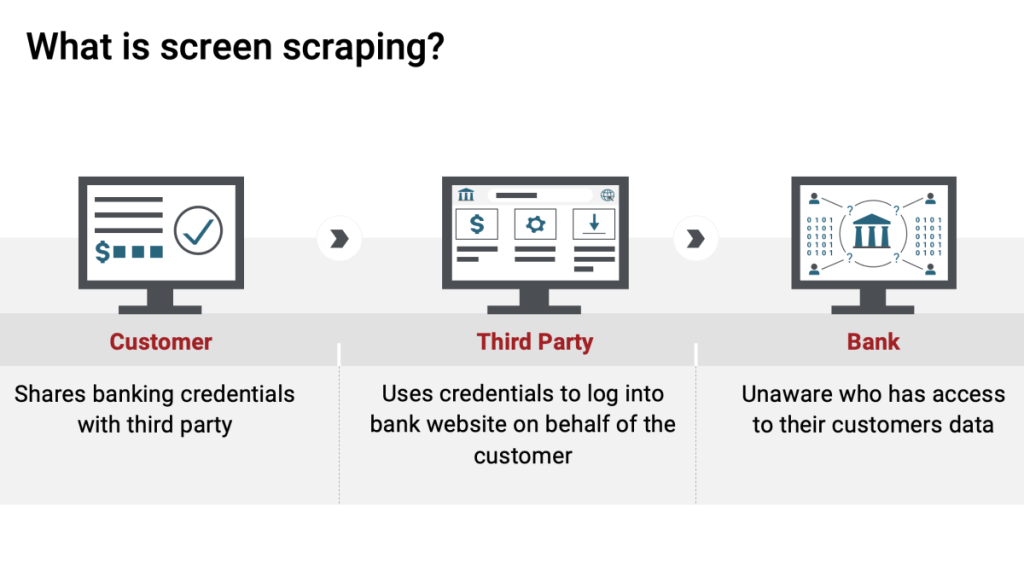

In the past, banks used screen-scraping to get and share financial data with others outside their system.

But this way of doing things was slow, unsafe, and sometimes messed up the data.

With banking APIs coming into the picture, sharing and combining data has improved greatly. It’s become more organized, safer, and works smoother than before.

These APIs let banks share data safely and efficiently with companies they trust while keeping everything secure and following all the rules that keep our information safe.

Payment Initiation Service Providers (PISPs) connect to a customer’s bank account and initiate payments on behalf of the customer, and they need to comply with multiple requirements to access and use these APIs.

This easy connection helps banks collaborate with third-party companies to develop new financial products that make our lives easier.

Using these tools to securely connect different systems and share important information, like financial data, ensures everyone follows necessary privacy laws, too!

Plus, it opens doors to create cool new services or stuff we use daily.

Open Banking and Its Impact on Financial Services

The impact of open banking on financial services is profound and multifaceted. It’s catalyzing innovation at an unprecedented pace, enabling the creation of new financial products and services that were previously impractical or impossible.

Open banking APIs are revolutionizing the financial services industry by promoting innovation, increasing competition, and improving customer experience.

For instance, this has allowed new and innovative services to emerge rapidly, supported by the foundational technologies provided by companies like Truelayer and Tink, which facilitate data access and complete end-to-end solutions for payments and financial management.

These providers aggregate data from multiple banks and provide data access and transfer on the back end via APIs that power consumer-facing providers.

Open banking is also intensifying competition in the financial sector.

It lowers the barriers to entry for new players.

It lets consumers gain more control over their financial data.

Fosters an environment of collaboration and partnership, leading to competitive advantages in rapidly evolving markets.

It challenges the dominance of established banks and spurs them to innovate.

In the UK, challenger banks like Monzo and Starling have leveraged open banking to offer innovative services and capture significant market share.

These banks have grown rapidly, with Monzo reaching over 7 million customers in just five years, demonstrating the appetite for innovative financial services enabled by open banking.

In addition, open banking enables more accurate credit assessments by making it easier for individuals and small businesses to share their financial data.

This benefits those with thin credit files or non-traditional income sources.

For example, UK-based fintech Iwoca uses open banking data to offer small businesses faster and fairer credit decisions.

Iwoca uses open banking account data to make decisions based on a business’s full trading history, not just a credit score. This allows them to offer instant decisions on business loans up to £25,000 and decisions within 24 hours for loans up to £500,000.

The impact extends beyond retail banking.

For example, Coupa uses open APIs from Citi to allow its corporate customers to request virtual cards by submitting a purchase requisition through Coupa.

This embedded experience improves efficiency and user satisfaction for the corporate client.

Regulatory Frameworks Shaping Open Banking Globally

Regulatory frameworks shape the global space of open banking, each tailored to the unique financial ecosystems of different regions.

These regulations are the catalysts driving the open banking revolution, setting data sharing, security, and consumer protection standards.

In Europe, the revised Payment Services Directive (PSD2) has been the cornerstone of open banking regulation.

PSD2 mandates that banks in the European Union must allow third-party providers access to customer account data provided the account holder gives consent.

This directive has fundamentally altered the competitive landscape, forcing banks to innovate and collaborate with fintech companies.

According to the search results, 572 third-party providers (TPPs) were registered across the UK and the European Economic Area (EEA) as of the end of 2023.

Specifically:

In the EEA, 364 TPPs had gained regulatory permissions, a net increase of 9 TPPs over the second half of 2023.

In the UK and Gibraltar, 208 TPPs had gained regulatory approval, a net increase of 6 TPPs over the same period.

The search results indicate that open banking in Europe is continuing to grow, with nearly half of all EEA TPPs now passporting their services to countries outside their domestic market

The US doesn’t have a single federal regulation equivalent to PSD2. Instead, various federal laws and regulations, such as:

They cover different aspects of payment services.

Also, industry standards like EMVco (for card-based payments) and PCI DSS (Payment Card Industry Data Security Standard) are used to ensure security and compliance in the payment industry.

These standards are similar to the security measures mandated by PSD2.

The United Kingdom has taken a particularly proactive approach to open banking.

The Competition and Markets Authority (CMA) mandated that the nine largest banks in the country implement open banking standards.

This initiative goes beyond PSD2, specifying standardized API formats and establishing a centralized implementation entity. The results have been impressive.

According to KPMG, by January 2024, the number of active Open Banking users in the UK had surpassed 9 million, reflecting a consistent annual increase in adoption among individual consumers and businesses.

In contrast, the United States has adopted a more market-driven approach to open banking.

While no comprehensive federal regulation mandating open banking exists, initiatives like the Financial Data Exchange (FDX) are working to standardize secure data-sharing practices.

The Consumer Financial Protection Bureau (CFPB) has also signaled its intent to develop consumer data access rights regulations, potentially paving the way for a more structured open banking framework.

Other regions are following suit with their approaches:

Australia introduced the Consumer Data Right (CDR) legislation in 2019, starting with the banking sector. This phased approach began with the four major banks and gradually expanded to include all banks.

Singapore has been a pioneer in Asia, with the Monetary Authority of Singapore (MAS) releasing API guidelines for open banking as early as 2016. Hong Kong has also made strides, introducing its Open API Framework in 2018.

Brazil has taken a bold step by mandating open banking through a resolution by the National Monetary Council, with implementation beginning in 2021.

While diverse in their approaches, these regulatory frameworks share common objectives: fostering innovation, enhancing competition, and empowering consumers.

They’re setting the stage for a new era of financial services, one in which data flows freely (but securely) between institutions, and consumers have unprecedented control over their financial information.

The global nature of these regulations is also driving standardization efforts.

Initiatives like the Berlin Group in Europe are working to create common API standards across the EU to facilitate a uniform approach.

The Berlin Group, which includes nearly 40 banks, payment service providers, and financial associations, has developed the “NextGenPSD2” standard to address PSD2’s requirements.

This standard has been adopted by institutions such as the National Bank of Greece (NBG), enabling them to provide comprehensive access to account and transaction data through these standardized APIs.

This adoption underscores a significant move towards enhanced interoperability and efficiency in European financial services.

Technological Foundations of Banking APIs

The technological infrastructure underpinning banking APIs is a sophisticated ecosystem of platforms, protocols, and security measures.

This foundation is crucial for enabling the functionality of open banking and for ensuring the integrity and security of sensitive financial data.

API platforms are at the heart of this infrastructure, serving as the backbone for creating, managing, and securing APIs in the banking sector.

These platforms offer a comprehensive suite of tools that enable banks to expose their services securely, manage access, and monitor usage.

For instance, Plaid is the leading API management platform banks use in the USA.

Plaid, based in San Francisco, California, is an API aggregator. Its technology platform enables applications to connect with users’ bank accounts by providing a standardized API across various financial institutions.

The architecture of these API platforms is typically built on microservices, allowing for greater flexibility and scalability.

This approach enables banks to update and deploy individual services without affecting the entire system, a crucial capability in the fast-moving world of fintech innovation.

Key Technologies Enabling Open Banking APIs

The technical implementation of open banking APIs relies on several key technologies:

RESTful Architecture: Most banking APIs adopt REST (Representational State Transfer) principles. REST APIs are stateless, making them ideal for the web-based nature of open banking. They’re also easier to scale and maintain, which are crucial factors in an environment where API calls can number in the millions daily.

OAuth 2.0 and OpenID Connect: These protocols form the cornerstone of secure authorization and authentication for API access. OAuth 2.0 provides a standardized way for third-party applications to access user accounts without exposing passwords. OpenID Connect, built on OAuth 2.0, adds an identity layer, allowing for robust user authentication.

JSON (JavaScript Object Notation): This lightweight data interchange format is widely used for API responses due to its simplicity and efficiency. JSON’s human-readable format makes it easier for developers to work with, speeding up integration processes.

Webhooks: These allow for real-time notifications, enabling applications to receive instant updates on account activities. For example, a budgeting app can be immediately notified when a user purchases, allowing real-time budget tracking.

API Gateways: These are a single entry point for all API calls, providing crucial functions like request routing, composition, and protocol translation. They also play a vital role in security, handling tasks like authentication and rate limiting.

The implementation of these technologies varies across different open banking initiatives.

For example, the UK’s Open Banking Implementation Entity (OBIE) has developed a highly standardized set of APIs based on these technologies, ensuring consistency across different banks.

In contrast, the U.S. market has seen a more fragmented approach, with individual banks developing their API standards, though initiatives like FDX are working towards greater standardization.

Security Protocols and Data Protection in API Integration

Security is also paramount in open banking APIs.

The sensitive nature of financial data necessitates robust security measures at every level of the API ecosystem.

Key security protocols include:

End-to-End Encryption: All data transmitted via APIs is encrypted using protocols like TLS (Transport Layer Security). This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Strong Customer Authentication (SCA): As mandated by regulations like PSD2, this requires multi-factor authentication for certain transactions. It involves a combination of something the user knows (like a password), something they have (like a phone), and something they are (like a fingerprint).

Tokenization: Instead of transmitting actual account numbers or other sensitive data, tokenization replaces this information with unique identification symbols that retain all the essential information about the data without compromising its security.

API Rate Limiting: This prevents abuse by limiting the number of API calls a client can make within a given timeframe. It’s crucial for preventing denial-of-service attacks and ensuring fair usage of API resources.

Regular Security Audits: Banks and fintech companies conduct thorough security assessments to identify and address vulnerabilities in their API infrastructure. These often include penetration testing and code reviews.

The implementation of these security measures is not without challenges.

Implementing these security measures is not without challenges, particularly in the USA.

Banks and credit unions have raised concerns about the Consumer Financial Protection Bureau’s (CFPB) open banking framework.

Financial institutions are particularly anxious about the potential liability they could face if a data aggregator or fintech suffers a security breach.

There is also significant worry about fintech companies’ misuse of customer data, which could lead to violations of privacy rights.

These issues highlight the critical need for robust security protocols and clear regulatory guidelines to protect consumer privacy and the financial institutions’ interests in the evolving landscape of open banking.

As the open banking landscape evolves, so do the security protocols protecting it.

Emerging technologies like AI and machine learning are being employed to detect fraudulent activities in real time, adding a layer of security to open banking ecosystems.

Practical Applications of Banking APIs

These APIs are the backbone of numerous innovative solutions reshaping the banking landscape, offering unprecedented convenience, personalization, and efficiency to consumers and businesses alike.

Some of the top practical applications of open banking APIs include:

1. Enhancing Customer Experience Through Personalized Banking Services

The ability to offer highly personalized banking services is one of the most compelling applications of banking APIs.

By accessing a wealth of financial data, banks and fintech companies can tailor their offerings to individual customer needs and behaviors.

For example, Square, a leading fintech company, has significantly impacted B2C transactions with its user-friendly payment solutions powered by APIs.

Moreover, banking APIs are enabling the creation of contextualized financial services.

APIs facilitate smoother interactions within financial apps, allowing for features like real-time updates, personalized alerts, and a seamless user interface that adjusts to user preferences and behaviors.

An example of this is the Capital One DevExchange API. This platform allows developers to access banking functionalities such as account details, transaction history, and reward points.

The personalization extends to credit decisions as well.

Lenders use banking APIs to access rich transaction data, allowing for more accurate risk assessments.

This is beneficial for individuals with thin credit files or non-traditional income sources.

For example, UK-based Creditspring uses open banking data to offer more inclusive credit products, considering factors beyond traditional credit scores.

Improved Product Recommendations: Banks can analyze spending patterns to suggest relevant financial products.

Enhanced Budgeting Tools: Apps can provide real-time insights into spending across multiple accounts.

Tailored Financial Advice: AI-powered chatbots can offer personalized financial guidance based on transaction history.

Streamlined Loan Applications: Lenders can instantly access financial data, speeding up the approval process.

Contextual Offers: Banks can provide timely offers based on location or spending behavior.

2. Streamlining Payments and Transfers with API Solutions

Banking APIs are driving significant innovations in payments and transfers.

They enable faster, more secure, and more convenient payment experiences for consumers and businesses.

One of the most notable applications is real-time payments. In the UK, the Faster Payments Service leverages banking APIs, allowing for near-instantaneous transfers between bank accounts.

Similar systems are being implemented worldwide, with the U.S. Federal Reserve launching its FedNow Service in 2023, which relies heavily on API technology.

Banking APIs are also facilitating the growth of alternative payment methods. Companies like Stripe and Square have built their entire business models around API-driven payment processing, allowing businesses of all sizes to accept a wide range of payment types easily.

These solutions have been particularly transformative for small businesses and e-commerce platforms, democratizing access to sophisticated payment infrastructure.

Banking APIs also enable more efficient solutions for cross-border payments, which are traditionally slow and expensive.

For example, Transferwise (now Wise) uses banking APIs to offer international transfers at a fraction of the cost of traditional bank transfers.

By connecting directly to bank accounts in different countries, Wise can bypass the traditional correspondent banking system, resulting in faster and cheaper transfers.

The impact of these API-driven payment solutions is significant.

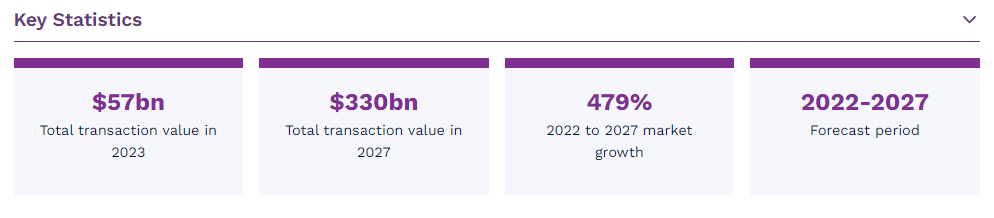

Some studies predict that the global value of open banking transactions will exceed $330 billion by 2027, up from around $57 billion.

As these applications demonstrate, banking APIs are not just a technological advancement but a catalyst for fundamental change in how financial services are delivered and consumed.

They’re breaking down barriers between financial institutions, fostering innovation, and ultimately giving consumers and businesses more power to manage their financial lives.

3. Fraud Detection and Prevention

Traditional fraud detection methods often relied on batch processing of transaction data, leading to delays in identifying and responding to suspicious activities.

With API-enabled real-time data access, banks can now monitor transactions as they occur, applying advanced analytics and machine learning algorithms to detect anomalies instantly.

For instance, HSBC has implemented an API-driven fraud detection system that analyzes real-time transactions across multiple channels.

This system can identify unusual patterns or behaviors that may indicate fraudulent activity, allowing the bank to take immediate action.

Moreover, banking APIs are enabling more collaborative approaches to fraud prevention. Banks can build more comprehensive fraud detection models by sharing data across institutions (with appropriate privacy safeguards).

4. Personal Finance Management

Banking APIs have revolutionized Personal Finance Management (PFM) tools, offering users unprecedented insights into their financial lives.

These tools can now aggregate data from multiple financial institutions, providing a holistic view of an individual’s finances.

Plaid, a fintech company specializing in bank account linking and verification APIs, has become a crucial player.

Their technology powers many popular PFM apps and connects to over 11,000 financial institutions across North America and Europe.

This broad coverage allows users to see all their financial accounts—checking, savings, investments, and loans—in one place.

The impact of these tools on personal financial management is significant. For example, YNAB, a personal financial management tool that uses financial APIs, claims that it has helped new users save an average of $6,000 in their first year on the app.

This increased financial awareness and control can lead to better financial decisions and improved financial health.

5. Facilitating Credit and Lending Services

Banking APIs are transforming the credit and lending landscape, making the process faster, more accurate, and more inclusive.

These APIs streamline loan applications and enable more nuanced credit assessments by providing lenders with direct access to verified financial data.

Traditional credit scoring methods often fail to capture an individual or business’s full financial picture.

Banking APIs allow lenders to access richer data, including real-time cash flow information, which can lead to more accurate risk assessments. This is beneficial for those with thin credit files or non-traditional income sources.

Kabbage, now part of American Express, is an excellent example of how APIs can revolutionize small business lending.

By using APIs to connect directly to a business’s bank accounts, accounting software, and other data sources, Kabbage can make lending decisions in minutes rather than days or weeks.

This speed and efficiency have made Kabbage a popular choice for small businesses needing quick access to capital.

Experian has launched a new credit scoring system that incorporates open banking data.

It aims to expand access to credit for the nearly 106 million “thin-file and invisible” US consumers who currently cannot secure credit at mainstream rates.

Early results show that layering banking data with traditional credit report information can boost predictive accuracy by up to 20% for lenders.

The impact of these API-driven lending solutions extends beyond convenience.

They also promote financial inclusion by enabling lenders to serve previously underserved populations through:

Faster Loan Processing: APIs enable near-instantaneous verification of financial information.

More Accurate Risk Assessment: Access to real-time transaction data allows for more nuanced credit decisions.

Improved Financial Inclusion: Alternative data sources help serve those with limited credit history.

Personalized Loan Offers: Lenders can tailor products based on an individual’s financial situation.

Ongoing Monitoring: APIs allow lenders to track borrowers’ financial health in real time, enabling proactive measures to prevent defaults.

As these applications demonstrate, banking APIs are improving existing financial services and enabling new approaches to long-standing financial challenges.

Strategic Advantages of Adopting Open APIs in Banking

By embracing open APIs, both old-school banks and fintech newbies gain big through the following ways:

1. Fosters Innovation and Collaboration in the Financial Ecosystem

The open API model has transformed the relationship between banks and fintech companies from competition to collaboration.

This shift creates a more dynamic and innovative financial ecosystem that benefits all stakeholders.

Partnerships with fintech companies allow banks to stay at the cutting edge of innovation without massive internal R&D investments.

Santander’s collaboration with Kabbage (before its acquisition by American Express) to offer small business loans is a prime example.

By leveraging Kabbage’s API-driven lending platform, Santander dramatically reduced loan decision times from weeks to minutes, enhancing its competitiveness in the small business lending market.

Kabbage’s automated lending platform, which uses data-driven underwriting, allows for faster credit decisions than traditional lending processes.

Fintech companies, in turn, benefit from access to banks’ large customer bases and established trust.

TransferWise (now Wise) has partnered with numerous banks worldwide, including France’s BPCE Group and Germany’s N26, to offer low-cost international money transfer services directly through these banks’ platforms.

This arrangement allows TransferWise to scale rapidly while providing banks with a competitive international transfer solution.

The collaborative environment fostered by open APIs also drives the creation of entirely new categories of financial services.

For instance, the rise of Banking-as-a-Service (BaaS) platforms like Railsbank enables companies to embed financial services into their offerings, blurring the lines between financial and non-financial companies.

More benefits of this partnership include:

Rapid Product Development: Banks can quickly launch new services by integrating third-party solutions.

Expanded Service Offerings: Partnerships enable banks to offer services beyond traditional banking.

Access to Innovative Technologies: Collaboration with fintech firms gives banks access to cutting-edge technologies like AI and blockchain.

Shared Risk and Investment: Partnerships allow for shared development costs and risks.

Enhanced Customer Insights: Integration with diverse services provides a more comprehensive view of customer behavior.

2. Accelerates Digital Transformation in Banking

Open APIs enable banks to move away from monolithic legacy systems towards more flexible, modular architectures that respond rapidly to changing market demands.

This API-driven approach allows banks to decompose their services into discrete, reusable components.

For example, ING Bank Śląski implemented the Agama API platform to manage services and adapt to the PSD2 directive.

This platform provided flexibility and security in managing APIs, ensuring compliance with regulatory requirements, and allowing the bank to update and deploy individual services independently.

This approach has significantly reduced the time-to-market for new features and improved the bank’s ability to scale its digital offerings.

Furthermore, open APIs enable banks to create more seamless, omnichannel customer experiences.

For instance, Capital One’s DevExchange platform provides APIs that allow the bank’s services to be integrated into various digital touchpoints, from mobile apps to voice assistants.

This capability ensures customers have consistent, high-quality interactions with the bank across all channels.

Open APIs are not just transforming customer-facing operations; they’re also revolutionizing back-office processes.

APIs enable seamless integration between different systems and departments, helping banks streamline operations, reduce manual interventions, and improve overall efficiency.

These API-enabled platforms have allowed JPMorgan Chase, for example, to reduce launch times, increase scalability, and improve cost efficiency.

3. Reduces Operational Costs Through API Integration

API integration facilitates seamless communication between different systems within a bank, eliminating the need for repetitive data entry and manual reconciliation.

This increases efficiency and improves the accuracy and timeliness of data processing.

Furthermore, APIs enable banks to leverage the capabilities of third-party service providers without the need for costly in-house development.

This “plug-and-play” approach allows banks to rapidly deploy new services and functionalities at a fraction of the cost of traditional development methods.

APIs’ cost-saving potential extends to customer service as well. Banks can significantly reduce the volume of customer service calls by enabling self-service capabilities through API-powered mobile and web applications.

4. Expands Market Reach with API-Enabled Services

API-enabled services present a transformative opportunity for banks to expand their market reach and tap into new customer segments.

By exposing their APIs to third-party developers and fintech companies, banks can extend their services beyond traditional banking channels and integrate them into various digital platforms and ecosystems.

This approach allows banks to meet customers where they are, embedding financial services seamlessly into their daily digital interactions.

Moreover, API-enabled services allow banks to target niche markets with tailored offerings more effectively.

Banks can quickly deploy products designed for specific customer segments by partnering with specialized fintech companies without requiring extensive in-house development.

The market expansion potential of API-enabled services is substantial. According to a McKinsey survey, 31% of banks expect their API efforts to increase their revenues by 10%.

Furthermore, banks plan to triple the number of “public APIs” used externally to generate revenue by 2025.

By embracing API-enabled services, banks can transform from mere providers of financial products to integral parts of broader digital ecosystems.

The Future Outlook for Banking APIs

As we look to the horizon of financial services, the trajectory of banking APIs points towards an increasingly interconnected, innovative, and customer-centric ecosystem.

The evolution of these technologies is set to redefine not just banking but the entire landscape of financial services and beyond.

Predicting Trends in Banking Innovation and API Development

The future of banking APIs is intrinsically linked to broader technological and societal trends.

One of the most significant developments we’ll likely see is the expansion of Banking-as-a-Service (BaaS) models.

This approach, enabled by robust API infrastructures, will allow non-financial companies to embed financial services into their offerings seamlessly.

For instance:

We might see ride-sharing apps offering instant loans to drivers for vehicle purchases

Or e-commerce platforms providing integrated business banking services to their merchants

Another emerging trend is the concept of “embedded finance,” which integrates financial services into non-financial products and services.

The market value of the embedded finance sector in the U.S. was estimated at $22.5 billion in 2020. It’s forecast to reach $730.5 billion by 2032, growing at a CAGR of over 29% from 2023 to 2032.

This growth will be powered by APIs seamlessly integrating financial services into various consumer and business touchpoints.

The rise of open finance is also on the horizon, extending the principles of open banking beyond traditional banking services to include investments, pensions, and insurance.

The UK’s Financial Conduct Authority is already exploring the potential of open finance, which could lead to more comprehensive financial management tools and personalized financial advice services.

Blockchain and distributed ledger technologies are also likely to play a significant role in the future of banking APIs.

These technologies could enable more secure and transparent data sharing, potentially revolutionizing cross-border payments and identity verification.

For example, JP Morgan’s Interbank Information Network, which uses blockchain technology to streamline cross-border payments, could be extended through APIs to offer these capabilities to a wider range of financial institutions and businesses.

The Role of AI and Machine Learning in Advancing Banking APIs

One of the most promising applications of Artificial Intelligence (AI) in banking APIs is personalized financial advice.

AI algorithms can provide highly tailored financial recommendations by analyzing vast amounts of transaction data and financial information accessed through APIs.

For instance, Bank of America’s AI-powered virtual assistant, Erica, integrates with the bank’s APIs. It provides personalized insights and has had over 2 billion interactions since its launch in 2018.

Machine Learning algorithms are also being employed to enhance fraud detection and prevention in API-driven banking services.

These algorithms can analyze patterns across millions of transactions in real time, identifying anomalies that might indicate fraudulent activity.

Visa’s AI-based fraud detection system processes over 2 million daily attempts by fraudsters and keeps fraud rates at historic lows of about 7 cents per $100 in transactions.

The Visa Advanced Authorization (VAA) score uses AI and machine-learning techniques to determine whether a transaction is legitimate or fraudulent within 300 milliseconds.

In addition, AI and ML are crucial to improving the operational efficiency of API management itself.

These technologies can optimize API performance, predict and prevent potential failures, and even suggest improvements to API design based on usage patterns.

For instance, Google Cloud’s Apigee API Management Platform uses AI to provide predictive analytics and anomaly detection for API traffic, helping banks ensure the reliability and performance of their API infrastructure.

Combining AI, ML, and APIs also enables more sophisticated credit scoring models.

By analyzing alternative data sources accessed through APIs, such as social media activity or mobile phone usage, AI algorithms can assess creditworthiness for individuals with limited traditional credit history.

This approach could significantly expand financial inclusion, particularly in developing markets, through:

Hyper-Personalization: AI-driven APIs will enable highly customized financial products and services.

Predictive Analytics: Machine Learning models will provide forward-looking insights based on API-accessed data.

Enhanced Security: AI algorithms will continuously adapt to new security threats in real time.

Automated Compliance: AI will help ensure API interactions comply with evolving regulations.

Natural Language Processing: APIs will increasingly support voice and text-based natural language interactions.

As we look to the future, banking APIs, enhanced by AI and ML, will continue to be at the forefront of innovation in financial services.

They will enable more seamless, intelligent, and personalized financial experiences, blurring the lines between traditional banking and other aspects of our digital lives.

The financial institutions that successfully harness these technologies will be well-positioned to lead in this new era of digital finance.

Conclusion

The revolution in banking brought about by open APIs is not just a technological shift; it’s a fundamental reimagining of how financial services are delivered and consumed.

As we’ve explored throughout this article, banking APIs drive innovation, foster collaboration, and create new possibilities for established financial institutions and emerging fintech players.

The benefits of this transformation are manifold.

For consumers, it means greater control over their financial data, more personalized services, and a wider range of innovative financial products.

For banks, it offers opportunities to expand their reach, improve operational efficiency, and tap into new revenue streams.

And for fintech companies, it provides the foundation for creating groundbreaking solutions that address longstanding financial challenges.

However, this journey is not without its challenges. Security concerns, regulatory complexities, and the need for standardization remain ongoing issues that the industry must continue to address.

Yet, the progress made thus far demonstrates the financial sector’s resilience and adaptability to these challenges.

Looking ahead, the future of banking APIs is bright and full of potential.

As AI and machine learning capabilities advance and concepts like embedded finance and open finance gain traction, we can expect to see even more innovative applications of banking APIs.

In this new era of finance, success will belong to those who can effectively harness the power of APIs to create value for customers, navigate regulatory landscapes, and stay ahead of technological curves.

As the financial world becomes increasingly open and interconnected, banking APIs will continue to be the vital connective tissue that enables innovation, collaboration, and growth.

What Are the Most Common Use Cases for Banking APIs?

The most common use cases for banking APIs include account aggregation, allowing users to view all their financial accounts in one place; payment initiation, enabling third-party apps to initiate payments directly from a user’s bank account; personal financial management, providing insights into spending patterns and budgeting; lending and credit decisioning, streamlining loan applications and credit assessments; and identity verification and KYC processes, simplifying customer onboarding for financial services.

How Do Banking APIs Contribute to Financial Inclusion?

Banking APIs enable innovative fintech solutions that can reach underserved populations. They allow for the development of mobile banking apps, micro-lending platforms, and alternative credit scoring models that can serve individuals with limited banking history. APIs also facilitate the creation of low-cost, user-friendly financial products that can be accessed through smartphones, bringing banking services to remote areas and populations previously excluded from traditional banking systems.

Is Open Banking API Safe?

Open Banking APIs are designed with robust security measures to ensure the safety of financial data. They use strong encryption, secure authentication protocols like OAuth 2.0, and strict access controls. European regulatory frameworks such as PSD2 also mandate stringent security standards for open banking implementations.

What are the API Standards for Open Banking?

The API standards vary by region but aim to ensure interoperability, security, and consistency. The Berlin Group’s NextGenPSD2 framework in Europe provides a standardized set of APIs for PSD2 compliance. The UK has its own Open Banking Standard, developed by the Open Banking Implementation Entity. While there’s no official standard in the US, initiatives like the Financial Data Exchange (FDX) are working to create common API standards.

How Do Banking APIs Benefit Consumers?

Banking APIs enable consumers to access a wider range of financial services, enjoy more personalized banking experiences, and have greater control over their financial data.

What Is The Difference Between Open Banking And Banking APIs?

Open banking is a broader concept that involves banks opening up their data for third-party providers to access and use, typically through APIs. Banking APIs are the technical means through which this data sharing is accomplished.