With interest rates rising and inflation showing no signs of slowing down, many wonder: How can I protect my hard-earned savings and make smart loan decisions?

Will loan rates go down, or will savings rates go up?

In this article, we’ll examine key economic indicators and their intricate relationships, translating complex data into actionable strategies for your financial well-being.

Our research focuses on nine key datasets that directly impact your savings and borrowing decisions.

Federal Funds Rate

10-year Treasury Yield

Personal Loan Rates

Credit Card Interest Rates

10-year Breakeven Inflation Rate

Personal Saving Rate

Household Savings

Household Debt Service Payments

Gross Domestic Product (GDP) Growth

Economic indicators like the Federal Funds Rate and inflation forecasts empower you to predict shifts in loan and savings rates, compare the value of loans versus leases, and choose wisely between loans and credit cards.

Data Sources

The analysis we present in this article is based on robust, authoritative data from three primary sources:

Key Takeaways

Keep a close eye on the Federal Funds, inflation, and unemployment rates. These indicators strongly influence loan rates and savings yields.

With inflation eroding purchasing power, diversify your savings across high-yield savings accounts (currently offering up to 5.80% APY), inflation-protected securities like TIPS and I Bonds, and real assets such as real estate or REITs.

The strong correlation (0.904) between the Federal Funds Rate and personal loan rates suggests timing loans carefully. Consider locking in fixed-rate loans when rates are low and refinancing existing variable-rate debt when rates are rising.

Use the 50/30/20 rule as a starting point, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

With a strong correlation (0.78) between personal loan and credit card rates, but generally lower rates for personal loans, consider consolidating high-interest credit card debt into a personal loan to save on interest and pay off debt faster.

Maintain a robust emergency fund (3-6 months of expenses in a high-yield savings account), diversify investments across asset classes, and regularly review and adjust your financial strategy.

Table of Contents

Key Economic Indicators and Their Relationships

To make informed decisions about your savings and loans, you need to understand the economic forces at play.

In this section, we’ll break down the key economic indicators and analyze their complex relationships.

Learning from past financial crises, such as the savings and loan crisis, can provide valuable insights into today’s financial landscape.

This knowledge will serve as the foundation for the strategies we develop later in the article.

1. Federal Funds Rate and Its Impact

The Federal Funds Rate is a critical benchmark influencing nearly every aspect of the economy, especially interest rates. Let’s examine its relationships with other key indicators:

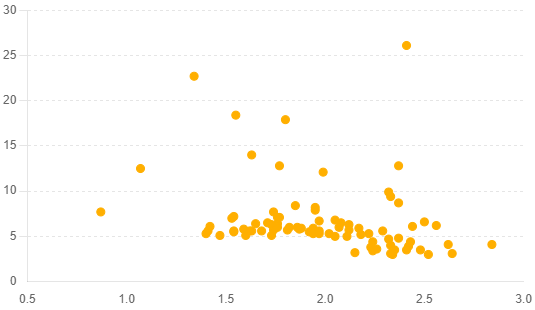

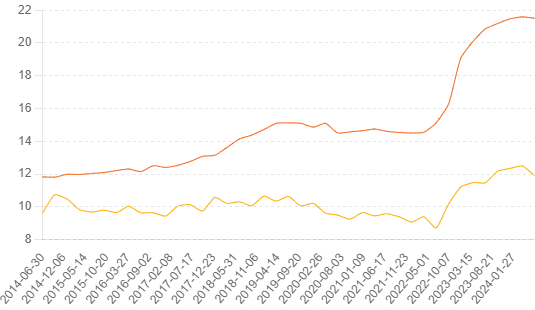

Federal Funds Rate and Personal Loan Rates

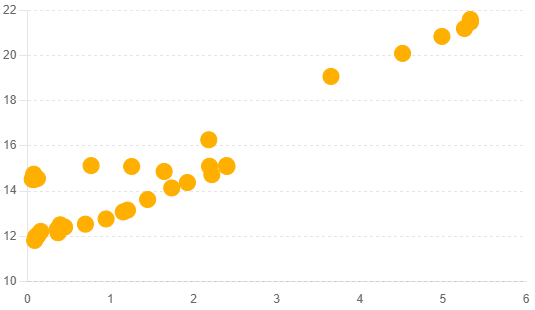

Correlation between the Federal Funds Rate and the Personal Loan Rate

Correlation coefficient: 0.904

This high positive correlation suggests a strong relationship between these two variables, indicating that the Personal Loan Rates tend to move in the same direction as the Federal Funds Rate changes.

Impact on you: When the Federal Reserve raises rates, expect your borrowing costs for personal loans to increase.

Federal Funds Rate and Credit Card Rates

Correlation coefficient between the Federal Funds Rate and the Credit Card Rate

Correlation coefficient: 0.912

Interpretation: Similar to personal loans, credit card rates positively correlate with the Federal Funds Rate. Credit card rates also tend to rise as the Federal Funds Rate increases.

Impact on you: Higher Federal Funds Rates mean higher interest charges on your credit card balances.

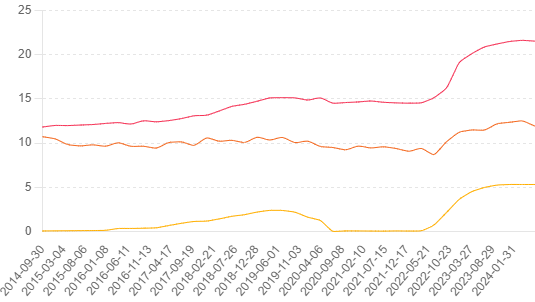

A line graph showing the trends of Federal Funds Rate, Personal Loan Rates, and Credit Card Rates over time, highlighting their correlations

Federal Funds Rate and Personal Saving Rate

Correlation between the Federal Funds Rate and the Personal Saving Rate

Correlation coefficient: -0.39

Interpretation: This indicates a moderate negative correlation. As the Federal Funds Rate increases, the Personal Saving Rate tends to decrease, albeit not strongly.

Rising interest rates lead to lower overall savings rates, possibly due to increased borrowing costs or shifts towards higher-yielding investments.

2. 10-Year Treasury Yield

The 10-year Treasury Yield is a crucial indicator for long-term interest rates.

It moves in tandem with the Federal Funds Rate but can diverge based on long-term economic expectations.

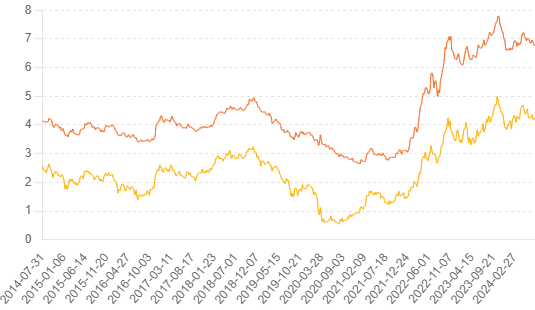

10-Year Treasury Yield and Mortgage Rates

Both the Treasury Yield and mortgage rates generally move in tandem, reflecting the influence of long-term interest rate trends on mortgage rates.

There may be periods where these rates diverge due to different factors influencing long-term economic expectations and the mortgage market.

Monitoring the 10-year Treasury Yield can help you anticipate changes in mortgage rates, which is crucial for home buying or refinancing decisions.

A chart comparing the 10-year Treasury Yield trend with average 30-year fixed mortgage rates over time

3. 10-Year Breakeven Inflation Rate

This rate reflects market expectations for average inflation over the next decade.

Its relationships with other indicators provide insights into how inflation expectations impact financial behaviors.

10-Year Breakeven Inflation Rate and Personal Saving Rate

10-Year Breakeven Inflation Rate and Personal Saving Rate correlation

Correlation coefficient: -0.26

This moderate negative correlation indicates that the personal saving rate tends to decrease as inflation expectations rise.

Higher expected inflation might discourage traditional saving methods, as the real value of money erodes over time.

10-Year Breakeven Inflation Rate and Loan Rates

Correlation with Credit Card Rates: 0.37

Correlation with Personal Loan Rates: -0.03

A moderate positive correlation indicates that as the breakeven inflation rate rises, credit card rates also tend to increase.

The correlation is negligible, suggesting little to no linear relationship between the breakeven inflation rate and personal loan rates.

In periods of higher expected inflation, you see little to no linear relationship to an increase in borrowing costs.

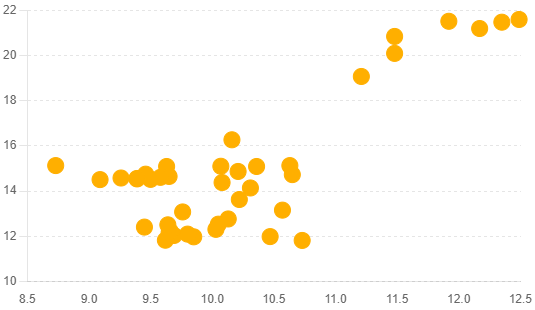

4. GDP Growth and Personal Saving Rate

Understanding how economic growth relates to saving behaviors provides insights into broader economic trends.

The correlation coefficient between GDP (Gross Domestic Product) and the Personal Saving Rate

Correlation coefficient: -0.18

This weak negative correlation suggests that the Personal Saving Rate tends to decrease slightly as GDP increases, although the relationship is not strong.

Individuals might be more inclined to spend rather than save as the economy grows, though other factors could also influence this behavior.

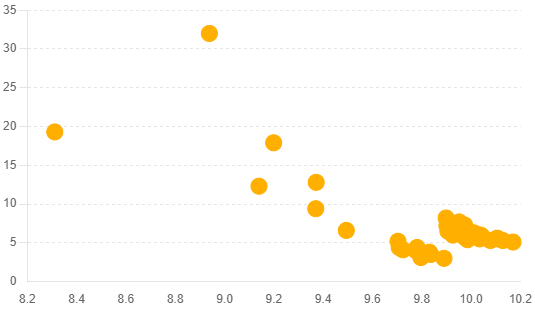

5. Household Debt Service Payments and Personal Saving Rate

This relationship is crucial for understanding how debt levels impact saving capacity.

The correlation coefficient between Household Debt Service Payments and the Personal Saving Rate

Correlation coefficient: -0.76

This strong negative correlation suggests that the personal saving rate decreases significantly as household debt service payments increase.

High debt levels severely limit your ability to save, creating a difficult financial bind to escape.

With these economic indicators and their relationships, you can now interpret economic trends and their potential impact on your financial decisions.

In the following sections, we’ll translate these insights into concrete strategies for protecting your savings and optimizing your loans in the current economic climate.

Strategies to Protect Your Savings Based on Economic Trends

Many people wonder, “Can savings lose value?” The answer is yes, especially when inflation outpaces interest rates.

Now that you know key economic indicators, let’s dive into practical strategies to shield your hard-earned savings from economic headwinds.

Remember, the goal is to save and grow your wealth in real terms.

Our analysis revealed a weak negative correlation (-0.26) between inflation expectations and the personal saving rate.

As people anticipate higher inflation, they tend to save less.

It’s a natural reaction. Why save if your money will be worth less tomorrow?

But don’t fall into this trap. Instead, consider ways to protect your savings from inflation’s erosive effects.

1. Invest in Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) and I Bonds are your allies in the fight against inflation.

These government-backed securities adjust with inflation, ensuring your purchasing power remains intact.

For example, you invest $10,000 in TIPS with a 0.5% real yield.

If inflation rises by 2% that year, your TIPS will be worth $10,251 at year’s end ($10,000 x 1.025 x 1.005).

Even though inflation ate away 2% of your money’s value, your TIPS investment grew to compensate.

So, consider allocating a portion of your portfolio to TIPS or I Bonds.

Remember, I Bonds have a purchase limit of $10,000 per Social Security number or Employer Identification Number per calendar year.

You can buy TIPS in $100 increments, which are available in 5, 10, and 30-year terms.

2. Explore Real Assets

Real estate and commodities often shine during inflationary periods.

They represent tangible assets that appreciate as the overall price level rises.

Let’s say you invested $200,000 in a rental property in 2019.

By 2024, even with a modest 3% annual appreciation, that property could be worth about $232,000.

Meanwhile, if you collect $1,500 in monthly rent, that’s an additional $90,000 in income over five years.

Compare this to leaving $200,000 in a savings account earning 1% interest, which would grow to only about $210,100 in the same period.

Consider Real Estate Investment Trusts (REITs) if direct property ownership isn’t feasible.

Diversify across different types of real estate (residential, commercial, industrial).

Look into commodity ETFs for oil, gold, or agricultural product exposure.

3. Maximize High-Yield Savings Accounts

While savings rates often lag behind inflation, high-yield accounts like Discover or Amex can help mitigate the impact.

As of July 2024, if you have $50,000 in savings, keeping it in a traditional savings account with a 0.24% annual percentage yield (APY) would earn just $120 in interest over a year.

However, moving that amount into an online high-yield savings account offering a much more competitive 5.84% APY could earn a substantial $2,920 in interest.

The difference in returns is stark.

Shop around regularly. Rates can change quickly, especially after Federal Reserve actions.

Consider online banks, which often offer higher rates due to lower overhead costs.

Be aware of any account minimums or fees that could affect your returns.

There are also high-yield savings accounts for businesses. So, don’t let your idle business cash lie in a traditional savings account.

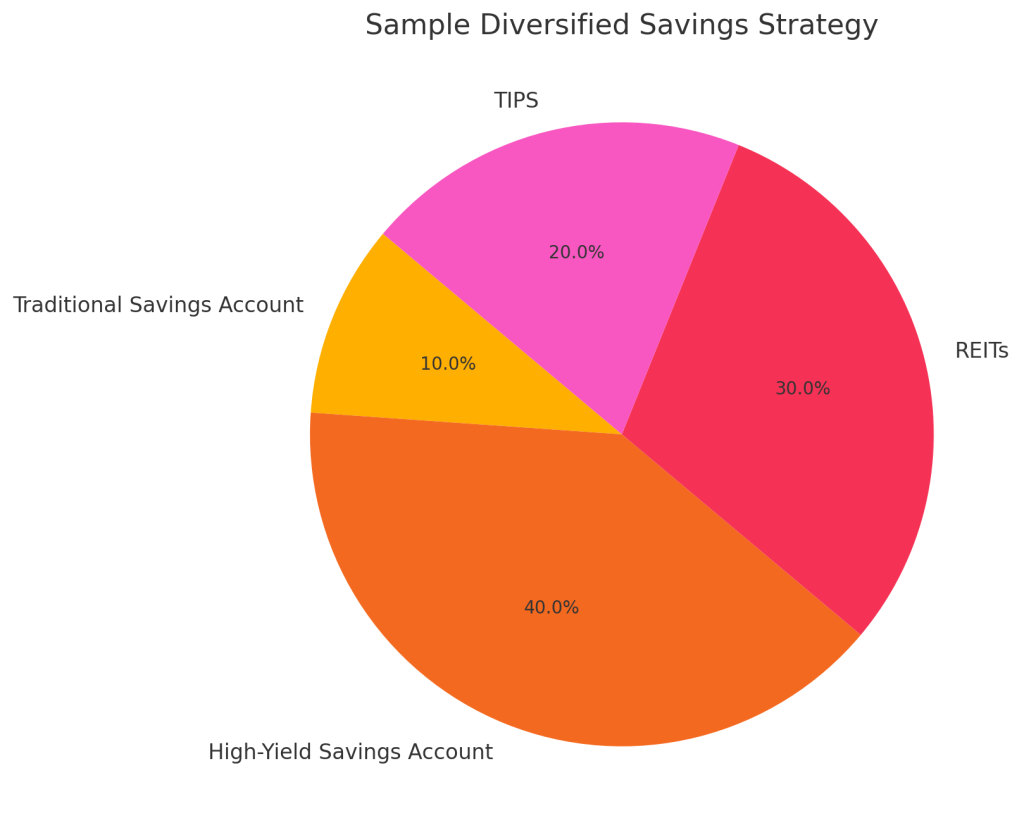

Here’s an overview of the current rates as of July 2024:

Traditional Savings Accounts: Offers a modest annual percentage yield (APY), with rates around 0.24%.

High-Yield Savings Accounts: Provide a more attractive APY than traditional savings accounts, ranging between 4.50% and 5.80%.

REITs (Real Estate Investment Trusts): REITs have an approximate return rate of 6%. Investing in REITs allows participation in the real estate market, often yielding higher returns than typical savings accounts, though with higher associated risks.

TIPS (Treasury Inflation-Protected Securities): The 5-Year TIPS/Treasury Breakeven Rate is 2.13%. TIPS are government securities designed to protect against inflation, providing returns that adjust based on changes in the inflation rate.

High-yield savings accounts are one of the most liquid savings vehicles for those prioritizing easy access to funds.

4. Balance Your Savings and Economic Growth

Our data showed a weak negative correlation (-0.18) between GDP growth and the Personal Saving Rate.

This suggests people save slightly less during economic booms.

It’s tempting to spend more when times are good, but maintaining a consistent savings habit is crucial for long-term financial health.

So, one, Automate Your Savings

Make saving a default action rather than a conscious choice.

Set up automatic transfers to your savings account coinciding with your payday.

For instance, if you earn $5,000 per month and aim to save 20%, set up an automatic transfer of $1,000 to your savings account on payday.

This way, you’re “paying yourself first” before you have a chance to spend the money.

Start with a percentage you’re comfortable with, even if it’s just 5% or 10%.

Gradually increase your savings rate over time, especially as your income grows.

Consider using apps like Acorns or Digit that round up your purchases and save the difference. Digit even analyzes your income and spending patterns and automatically withdraws small, affordable amounts into your savings account.

Diversify Your Savings

Don’t put all your eggs in one basket. Spread your savings across different types of accounts and investments to balance liquidity, safety, and growth potential.

Here’s an example of how you might diversify $10,000 in savings:

$3,000 in a high-yield savings account for easy access

$3,000 in a 12-month CD for slightly higher returns

$2,000 in a stock market index fund for long-term growth

$2,000 in bonds for stability and income

This approach gives you accessibility, guaranteed returns, and growth potential.

Maintain a Robust Emergency Fund

Aim for 3-6 months of living expenses in easily accessible savings.

This provides a buffer against unexpected events, regardless of economic conditions.

Calculate your monthly essentials: rent/mortgage, utilities, food, insurance, etc. Multiply this by 3-6 to determine your emergency fund goal.

For example, if your monthly essentials total $3,000, aim for $9,000 to $18,000 in your emergency fund.

Keep this money in a high-yield savings account for easy access.

Don’t be tempted to invest this money in the stock market; stability is key for emergency funds.

Review and adjust your emergency fund annually as your expenses change.

A Sample of a Diversified Savings Strategy

How to Optimize Your Loans in Light of Economic Indicators

As we’ve seen from our analysis of economic indicators, various factors influence loan rates and borrowing conditions.

When you understand these relationships, they help you make smarter decisions about when and how to borrow.

In this section, we’ll explore strategies for optimizing your loans based on the current economic space.

1. Personal Loans vs. Credit Cards: Make the Smart Choice

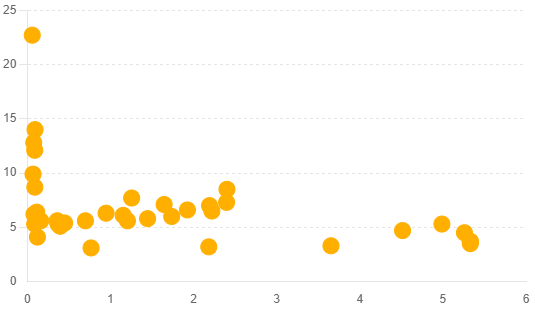

Our analysis revealed a strong correlation (0.78) between personal loan rates and credit card rates.

A scatter plot for the correlation analysis between personal loan rates and credit card rates

Both respond similarly to economic conditions, but credit card rates remain significantly higher. This difference creates an opportunity for savvy borrowers to save money.

Consider this scenario: You have $10,000 in credit card debt at an 18% APR.

By making minimum payments of $250 per month, you would pay off the debt in about 5 years, and you’d pay around $5,000 in interest.

Let’s say you consolidate this debt with a personal loan at 10% APR for a 3-year term. Your monthly payment would be about $323, but you’d pay off the debt two years earlier and save approximately $2,500 in interest.

Here’s how to approach this strategy:

Start by checking your credit score. A higher score typically means better loan terms.

Shop around with multiple lenders. Online lenders, credit unions, and traditional banks may offer different rates and terms. Some banks offer combined savings and checking account options for added convenience.

Pay attention to fees. Some personal loans come with origination fees that can eat into your savings.

Once you’ve consolidated, resist the temptation to rack up new credit card debt. Cut up old cards or freeze them in ice as a physical reminder to avoid using them.

It’s also important to understand the loan-to-value ratio concept, which can affect your interest rate and loan terms. Even those with less-than-perfect credit histories have options. Though rates may be higher, there are strategies for getting a loan with bad credit.

2. Time Your Loan Decisions Based on Federal Funds Rate Trends

The Federal Funds Rate has a high positive correlation (0.904) with personal loan rates.

This means that when the Federal Reserve increases rates, personal loan rates can generally be expected to rise as well, though not necessarily by the same amount or immediately.

Let’s look at a real-world example.

In March 2022, the Federal Reserve began a series of rate hikes to combat inflation. The average 24-month personal loan rate rose from about 9.5% in February 2022 to around 12% by the end of the year.

For a $20,000 loan over 24 months, this rate increase would mean paying about $530 more in interest over the life of the loan.

So, if you’re considering taking out a loan for a major purchase or project, pay close attention to Federal Reserve announcements and economic projections.

If indicators suggest that rates are likely to rise shortly, securing a loan sooner rather than later might be wise to lock in a lower rate.

Here’s how to use this information to your advantage:

Stay informed about Federal Reserve announcements and economic projections. Sites like the Federal Reserve Economic Data (FRED) provide up-to-date information.

If you’re planning a major purchase that requires a loan, and indicators suggest rates are likely to rise, consider securing your loan sooner rather than later.

In a decreasing rate environment, you might benefit from waiting to borrow or considering refinancing existing loans. However, don’t try to time the market perfectly – it’s risky and often counterproductive.

For existing loans, regularly check if refinancing could save you money as rates change.

Even a 1% decrease in your rate could lead to significant savings, especially on large, long-term loans like mortgages.

And if you’re struggling with student debt, explore loan forgiveness programs. You could get relief and improve your overall financial health.

3. Learn to Navigate Loans in an Inflationary Environment

Our analysis showed weak positive correlations between inflation expectations (measured by the 10-year Breakeven Inflation Rate) and loan rates (0.37 for credit cards) and a negligible correlation of -0.03 for personal loans, suggesting little to no linear relationship between the breakeven inflation rate and personal loan rates.

While these correlations aren’t strong, periods of higher expected inflation might see slightly higher borrowing costs.

However, inflation can work in your favor if you use loans for investments that appreciate. Here’s why:

Imagine you take out a $300,000 30-year fixed-rate mortgage at 4% to buy a home in 2024.

Your monthly payment (principal and interest) would be about $1,432. If inflation averages 3% per year:

In 10 years, that $1,432 payment will feel like $1,065 in today’s dollars due to inflation.

Meanwhile, your home’s value will likely increase with inflation (or more), potentially to around $403,000.

Inflation is helping you pay off your mortgage with “cheaper” dollars while your asset appreciates.

When making borrowing decisions in an inflationary environment, consider:

The purpose of the loan: Is it for an appreciating asset or consumable goods?

Your income prospects: Do you expect your income to keep pace with inflation?

The loan terms: Fixed-rate loans can provide certainty in an inflationary environment. Variable-rate loans start lower but increase over time.

Before finalizing a loan, you’ll receive a loan estimate. This document provides crucial information about your potential loan terms. You can use a loan estimate calculator to understand what to expect before applying.

How to Adapt Your Financial Strategies to Changing Economic Conditions

The economy is not static, and neither should your financial strategy be.

As we’ve seen from our analysis of various economic indicators, conditions can shift, sometimes rapidly.

Your ability to adapt your savings and borrowing strategies to these changes will significantly impact your financial health.

Let’s explore how to remain flexible and responsive to economic shifts.

1. Monitor Key Economic Indicators

To adapt effectively, you need to be well informed. Here are the key indicators to watch, how to interpret them, and what they mean for your financial decisions:

Federal Funds Rate

This is the interest rate banks charge each other for overnight loans, influencing other interest rates throughout the economy.

While this may seem far removed from your finances, it has a ripple effect throughout the entire economy, influencing everything from mortgage rates to the interest on your savings account.

How to monitor: The Federal Reserve announces rate changes after its Federal Open Market Committee (FOMC) meetings, which occur eight times yearly. You can find these announcements on the Federal Reserve’s website or in major financial news outlets.

What it means for you:

Rising rates: Consider locking in fixed-rate loans, as variable rates will likely increase. For savers, look for higher yields on savings accounts and CDs.

Falling rates: It might be a good time to refinance existing loans. For savers, consider locking in long-term CD rates before they fall further.

Example: In 2023, the Federal Reserve continued to raise the Federal Funds Rate multiple times to combat inflation.

The Federal Funds Rate was increased several times, from 4.50% to 4.75% in February 2023 and from 5.00% to 5.25% in May 2023. By July 2023, it was further raised to a range of 5.25% to 5.50%.

The average 30-year fixed mortgage rate rose significantly during this period, moving from around 3% at the beginning of 2022 to over 6% by mid-2023.

For a $300,000 mortgage:

At 3%, the monthly principal and interest payment would be about $1,265

At 6%, the payment jumps to around $1,799

Do you see how significantly Fed rate changes can impact your finances?

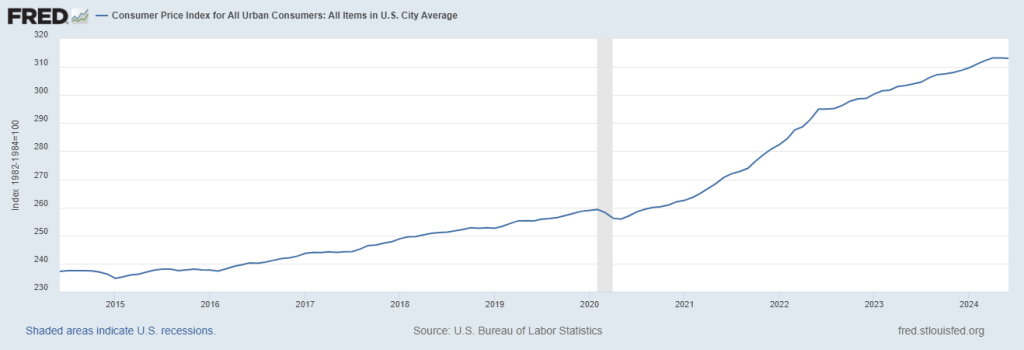

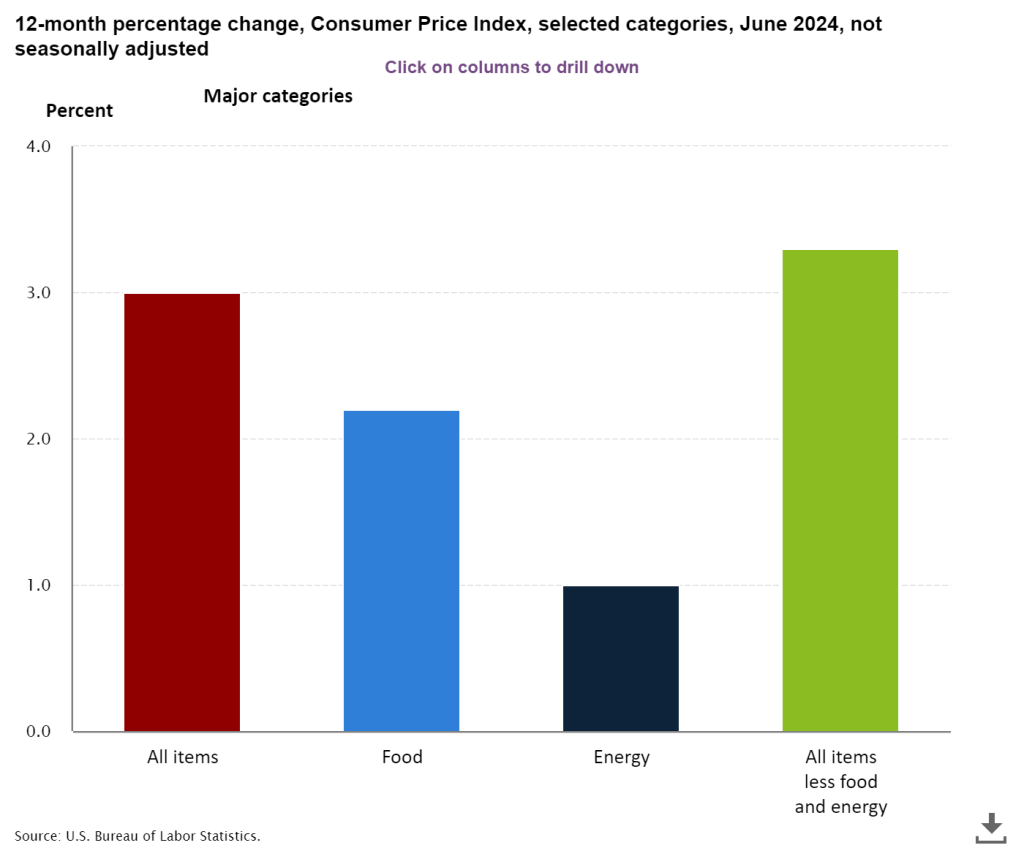

Inflation Rate (Consumer Price Index)

Inflation measures the rate at which the prices of goods and services rise over time.

The Consumer Price Index (CPI) is the most commonly used measure of inflation in the United States. It tracks the average price change that consumers pay for a basket of goods and services over time.

Consumer Price Index for All Urban Consumers All Items in the U.S. City Average (Source)

How to monitor: The Bureau of Labor Statistics releases CPI data monthly, usually around the middle of the month for the previous month’s data. You can find this information on their website or in financial news reports.

12-month percentage change, Consumer Price Index

What it means for you:

Your purchasing power is decreasing. $100 today will buy less in the future if inflation is high.

Focus on growing your money to outpace inflation. Consider Treasury Inflation-Protected Securities (TIPS), I Bonds, or equity investments that have historically outpaced inflation over the long term.

If you have fixed-rate debt, inflation can work in your favor, as you’re paying back the loan with “cheaper” dollars over time.

Traditional savings vehicles like high-yield savings accounts may provide satisfactory real returns (returns after accounting for inflation).

Low inflation environments often coincide with lower interest rates, which can be good for borrowers but challenging for savers.

Example: If inflation is 3% and your savings account pays 1% interest, you lose 2% of your money’s value yearly.

In this scenario, you should shift some savings to investments with potentially higher returns to preserve purchasing power.

Let’s say inflation is running at 3% annually, and you have $10,000 in a savings account earning 1% interest.

After one year:

Your balance will grow to $10,100

But the purchasing power of your money has decreased to about $9,806 ($10,100 / 1.03)

In real terms, you’ve lost about $194 of purchasing power.

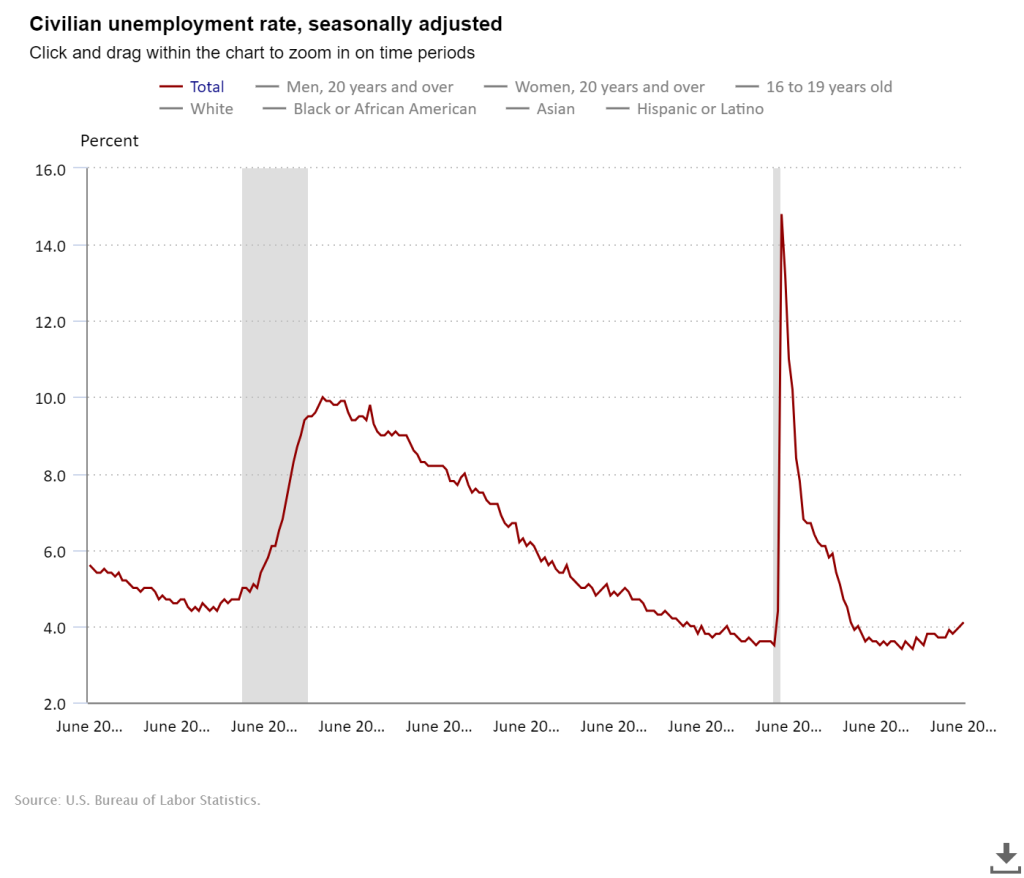

Unemployment Rate

The unemployment rate indicates the percentage of the labor force that is unemployed but actively seeking employment.

It’s a key indicator of the economy’s overall health and can influence government policy and personal financial decisions.

How to monitor: The Bureau of Labor Statistics releases this data on the first Friday of each month for the previous month. You can find it on their website or in major news outlets.

What it means for you:

The job market is weakening, which could mean increased job insecurity.

Consider boosting your emergency fund. Aim for savings of 6-12 months of expenses rather than the standard 3-6 months.

Be more conservative with investments. Increase your allocation to less volatile assets like bonds.

If you’re in the job market, be prepared for a longer job search and consider upskilling to make yourself more competitive.

If the unemployment rate is falling, then:

The job market is strong, which could mean more job opportunities and potentially higher wages.

You might be better positioned to negotiate a raise or seek a higher-paying job.

With more job security, you could be more aggressive with your investments, allocating more to stocks for potentially higher long-term returns.

It might be a good time to consider making major purchases or investments you’ve been putting off, as your income is more secure.

For example, during the COVID-19 pandemic, In April 2020, the U.S. unemployment rate surged to a record high of 14.7%, the highest level since the Great Depression. By June 2024, the unemployment rate is at 4.10%.

Civilian unemployment rate

In the high unemployment environment of 2020, many prioritized building cash reserves and reducing debt.

In the low unemployment environment of 2024, with a more secure job market, the focus has shifted to investing for growth and making major life decisions like buying a home or changing careers.

Understanding these indicators and their implications allows you to make more informed financial decisions.

2. Adjust Savings and Borrowing Strategies Based on Economic Trends

Now that we understand how to interpret key economic indicators, let’s examine how you might adapt your financial strategies in different economic scenarios:

During High Inflation

High inflation erodes the purchasing power of your money over time.

Your primary financial goal during periods of high inflation should be to ensure your money grows at a rate that at least keeps pace with inflation.

Savings strategy:

Shift towards inflation-protected securities like TIPS or I Bonds.

Consider increasing allocation to equities, particularly in sectors that historically perform well during inflation (e.g., energy, real estate).

Look into commodities or precious metals as a hedge against inflation.

Borrowing strategy:

If you have variable-rate debt, refinance to fixed-rate loans to protect against rising rates.

If you are planning large purchases, buying sooner rather than later might be better, especially if you can lock in a fixed-rate loan.

Consider increasing allocation to equities:

Stocks have historically outpaced inflation over long periods.

Look into sectors that often perform well during inflationary periods, such as energy, real estate, and consumer staples.

Explore alternative investments:

Commodities like gold or broad-based commodity ETFs can serve as a hedge against inflation.

Real estate, either through direct ownership or Real Estate Investment Trusts (REITs), often appreciates during inflationary periods.

You can also consider Cryptocurrency Retirement Accounts like Bitcoin IRA.

Example: Let’s say inflation rises to 5%. You have $50,000 in savings and earn 1% in a high-yield savings account.

You could adjust your strategy as follows:

Keep $10,000 in the high-yield savings account as an easily accessible emergency fund.

Invest $20,000 in TIPS to hedge against inflation directly.

Put $15,000 in a broad-market stock index fund for potential growth that historically has beaten inflation.

Invest $5,000 in a REIT index fund for exposure to real estate, which often performs well during inflation.

This diversified approach aims to protect your savings against inflation while still maintaining some liquidity and growth potential.

Understanding the differences between financing options is also crucial. For example, when considering a vehicle, you might weigh the pros and cons of a loan vs lease.

Similarly, it’s important to understand the differences between a loan and a credit card for personal financing.

During Economic Recession

Recessions are periods of economic decline, defined as two consecutive quarters of negative GDP growth.

They’re often characterized by higher unemployment, lower consumer spending, and increased economic uncertainty.

Savings strategy:

Aim for 6-12 months of expenses rather than 3-6 months.

This provides a bigger safety net in case of job loss or reduced income.

High-quality bonds or bond funds can provide stable, albeit lower, returns.

CDs offer better rates than savings accounts with the trade-off of less liquidity.

If you have a long time horizon, economic downturns can present buying opportunities:

Stock prices are often depressed during recessions, potentially allowing you to buy at a discount.

However, only invest money you won’t need in the short term, as markets can take time to recover.

Borrowing strategy:

Job insecurity increases during recessions, so be conservative about your ability to repay new loans.

If you must borrow, favor fixed-rate loans over variable-rate ones for more predictability.

If you have stable employment, falling interest rates during recessions might present refinancing opportunities:

Keep an eye on mortgage rates; refinancing could save you money if they drop significantly below your current rate.

The same applies to other types of loans, like auto or personal loans.

Example: During a recession, if you have $40,000 in savings, you might adjust your strategy like this:

Keep $30,000 in a high-yield savings account as an extended emergency fund.

Invest $5,000 in a high-quality bond fund for modest, stable returns.

If your job is secure, consider investing $5,000 in a stock index fund using dollar-cost averaging (investing a fixed amount regularly) to take advantage of potentially lower stock prices.

This approach prioritizes safety while positioning you to benefit from a future economic recovery.

During Economic Growth

Periods of economic growth are characterized by increasing GDP, often accompanied by lower unemployment and rising wages.

While these periods present opportunities, it’s important not to become complacent.

With potentially higher returns available, consider increasing contributions to retirement accounts:

If your employer offers a 401(k) match, try to contribute enough to get the full match.

Look into maxing out IRA contributions if you’re eligible.

Look into growth-oriented investments:

Stocks or stock mutual funds may offer higher potential returns during economic expansions.

Real estate investments, either direct or through REITs, also perform well.

Don’t neglect your emergency fund, but you may be able to take more investment risk:

Keep 3-6 months of expenses in easily accessible savings.

You might allocate a larger portion of your portfolio to stocks or other growth investments.

Additionally, rising interest rates often coincide with periods of economic growth.

If you’re planning a major purchase, such as a home, act sooner rather than later to lock in lower rates before they potentially increase.

For those with variable-rate debt, refinancing to a fixed rate could be a strategic move to avoid the impact of rising rates.

Also, as economic growth can lead to higher incomes, this might be an opportune time to pay down existing debt aggressively.

You could consider the debt avalanche method, which involves paying off debts with the highest interest rates first, thereby saving on overall interest payments.

Alternatively, the debt snowball method, which focuses on paying off the smallest debts first, can provide quick wins and help maintain motivation throughout the process.

Both approaches can effectively reduce debt, depending on your financial situation and psychological preferences.

When evaluating investment opportunities, consider the savings-to-investment ratio. Look for savings with high interest to maximize your returns, and explore options for savings without paying tax to keep more of your money.

For Example: In a growing economy, if you receive a 5% raise, adjust your financial strategy like this:

Increase your 401(k) contribution by 3% of your salary to boost retirement savings.

Use 1% to pay extra on high-interest debt, accelerating your debt payoff.

Save the remaining 1% in a high-yield savings account to bolster your emergency fund or for short-term goals.

This approach uses the growing economy to improve your overall financial position, balancing between increased savings, debt reduction, and maintaining liquidity.

3. Build Financial Resilience for Any Economic Climate

Regardless of current economic conditions, implementing certain strategies can help you build long-term financial resilience.

Diversification is key. By spreading your investments across different asset classes like stocks, bonds, and real estate, as well as across various sectors, you can mitigate risk and achieve more stable returns throughout different economic cycles.

Diversifying your savings can include options like savings bonds. However, note that savings bonds are subject to federal income tax on the interest earned, but they are not subject to state or local income tax.

Continuous learning is equally important—staying informed about personal finance and economic concepts empowers you to make well-informed decisions.

Regular financial check-ups, at least annually or whenever significant changes occur in your life or the broader economy, ensure that your financial strategy remains aligned with your goals and circumstances.

Maintaining flexibility by keeping some assets liquid is crucial, allowing you to adapt to changing conditions or capitalize on new opportunities.

While adjusting to economic shifts is important, it’s wise to avoid drastic actions based on short-term news.

Your financial strategy should be anchored in long-term goals and risk tolerance.

Final Thoughts: Implement Your Strategy

As you move forward, remember that personal finance is personal.

While the strategies outlined in this article are based on sound economic analysis, they should be adapted to fit your circumstances, goals, and risk tolerance.

Start by assessing your current financial situation.

What’s your debt-to-income ratio?

How much do you have saved?

What are your short-term and long-term financial goals?

Use this information as a baseline to implement the strategies we’ve discussed.

Next, create a plan. Decide which strategies you’ll prioritize based on your assessment.

Perhaps you’ll start by building up your emergency fund, then move on to tackling high-interest debt. Or you’ll focus on diversifying your savings to protect against inflation.

Remember to review and adjust your plan regularly. Economic conditions change, and so do personal circumstances. What works today may need tweaking in six months or a year.

Finally, don’t be afraid to seek professional advice.

A financial advisor can help you tailor these strategies to your specific situation and provide personalized guidance as you navigate the complex world of personal finance.

Your financial journey is a marathon, not a sprint. Stay informed, remain flexible, and keep your long-term goals in sight.

Which strategies will you start implementing to protect your savings and optimize your loans in 2024?

Frequently Asked Questions

What is the 50/30/20 rule?

The 50/30/20 rule budgeting strategy divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This helps you balance essential expenses, discretionary spending, and financial goals, making managing your money effectively and building long-term financial stability easier.

How can I reduce my debt and increase my savings?

Create a budget, cut unnecessary expenses, pay more than the minimum on debts, use the debt avalanche method, automate your savings, and increase your income. Prioritize high-interest debt while maintaining an emergency fund. Consider balance transfer offers or debt consolidation loans to lower interest rates and accelerate debt repayment.

How to get rid of loans?

Make extra payments, use the debt avalanche method (paying off the highest-interest debt first), refinance to lower interest rates, use windfalls for lump-sum payments, and consider a side hustle for extra income. Create a realistic budget that maximizes the amount you can put towards loan repayment each month. If eligible, investigate forgiveness programs for student loans.

What do I do if I’m in debt and have no money?

If you’re in debt with no money, create a bare-bones budget, contact creditors to negotiate payment plans, seek credit counseling, explore debt consolidation options, look for ways to increase income, and consider selling unnecessary items. In severe cases, research debt settlement or bankruptcy, but consider these a last resort. Remember, many creditors offer hardship programs that can provide temporary relief.

Is it better to pay debt or save?

With high-yield savings accounts offering APYs of 4.50% to 5.80%, here’s a data-driven approach:

If your debt’s interest rate is higher than savings account yields (e.g., most credit card debt), prioritize debt repayment.

If savings account yields exceed your debt’s interest rate, prioritize saving while making minimum debt payments.

Always maintain an emergency fund of 3-6 months’ expenses in a high-yield savings account.

You might benefit more from saving and investing for student loans or mortgages with rates lower than current savings yields.

How can I protect my savings from inflation in 2024?

Diversify into inflation-protected investments such as Treasury Inflation-Protected Securities (TIPS) and I Bonds. Additionally, explore high-yield savings accounts, often offering better interest rates than traditional ones. Real assets like real estate or commodities can also be hedges against inflation.

How does the Federal Funds Rate impact my loans and savings in 2024?

Our analysis shows a high positive correlation (0.904) between the Federal Funds Rate and personal loan rates. When the Fed raises rates, expect borrowing costs to increase. However, this can also lead to higher yields on savings accounts and CDs.

What are the best high-yield savings accounts in 2024?

Flagstar Bank: 5.55% APY

Poppy Bank: 5.50% APY

My Banking Direct: 5.45% APY

Forbright Bank: 5.30% APY

Vio Bank: 5.30% APY

While not currently offering the highest rates, well-known online banks like Discover and American Express (Amex) are also worth considering.

Which economic indicators should I monitor to make informed financial decisions in 2024?

The Federal Funds Rate: Influences loan and savings rates

Inflation Rate (CPI): Affects the purchasing power of your money

Unemployment Rate: Indicates overall economic health

10-Year Treasury Yield: Impacts long-term loan rates, especially mortgages

GDP Growth: Reflects overall economic conditions