You don’t always need to reinvent the wheel when growing your small business.

Tried-and-tested methods, like customer financing, can make a big difference.

How? When your customers break down payments into manageable chunks, they will likely make larger purchases.

Table of Contents

Why Customer Financing is Important for Small Businesses in 2024

I like numbers. Let us start with the numbers. They tell the real story.

- 76% of customers are more likely to purchase when financing is available, reducing the hesitation that comes with high upfront costs.

- According to data from Stripe, small businesses offering Buy Now, Pay Later (BNPL) report an average 14% increase in revenues. Financing also allows customers to upgrade to premium products or buy more items than initially intended.

- 78% of customers said they choose to buy more from a retailer that offers financing over one that doesn’t.

- E-commerce businesses that offer financing services, such as BNPL, have seen cart conversion rates increase by as much as 40%.

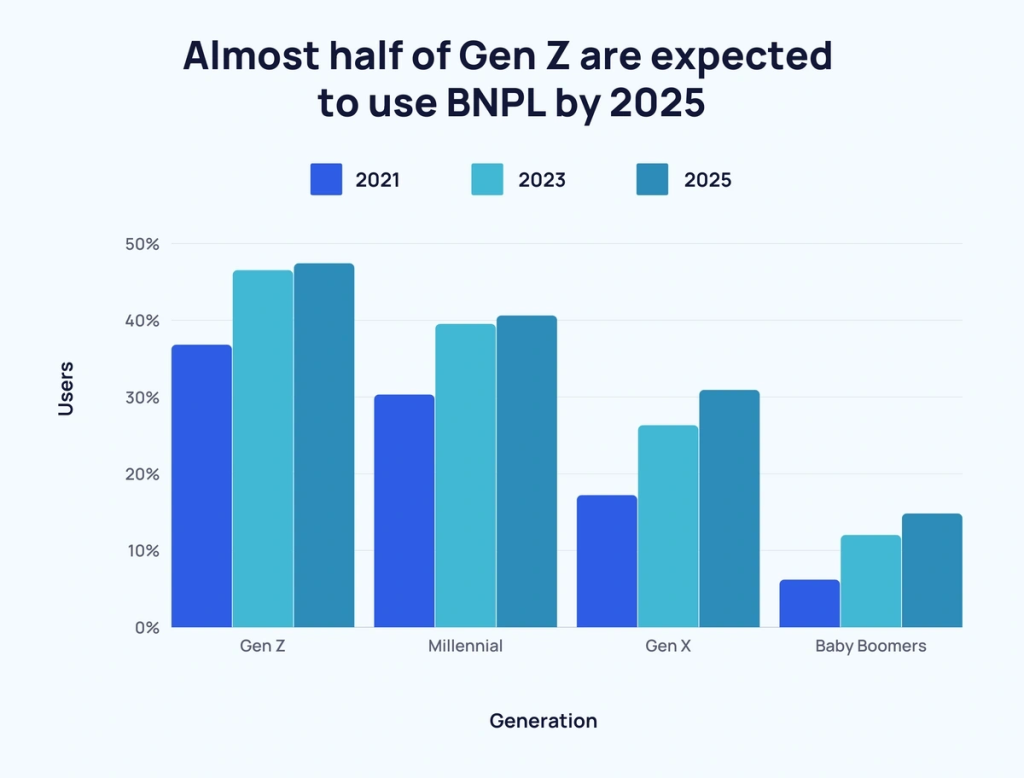

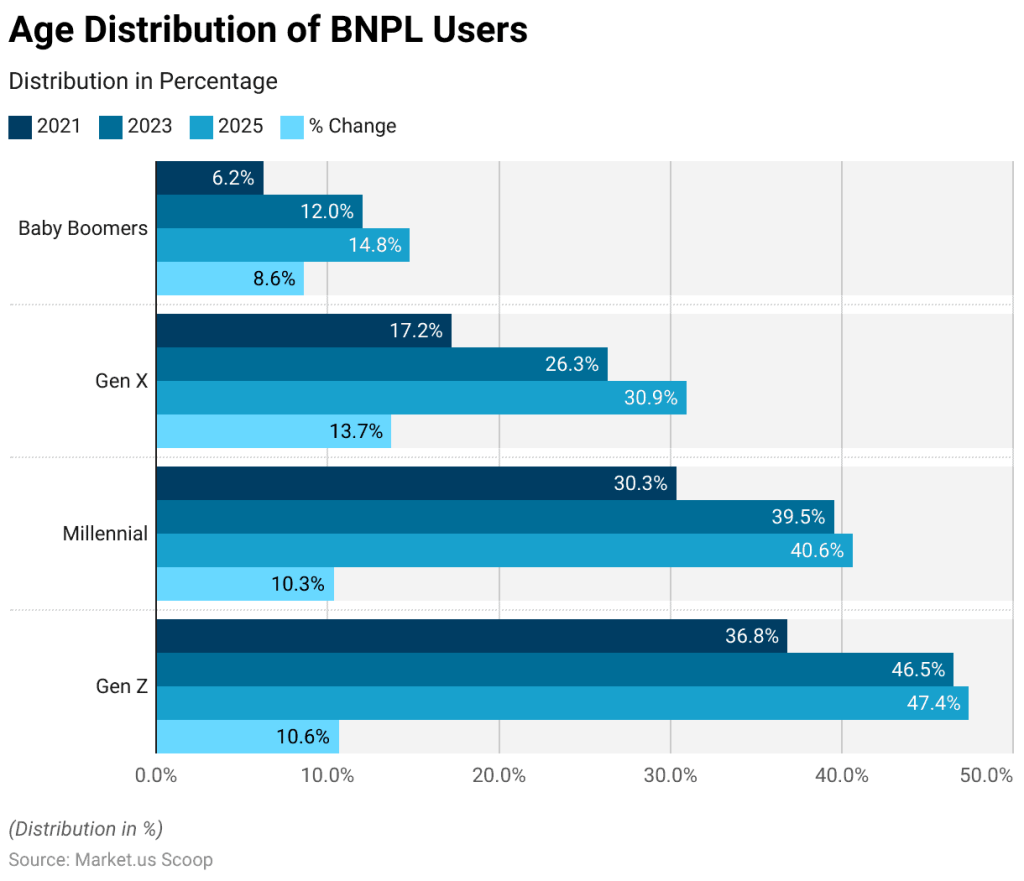

- Gen Z is the generation that uses BNPL the most, and adoption rates among them are expected to increase from 36.8% in 2021 to 47.4% by 2025. Although older generations are less likely to use BNPL, an increase is expected across all age groups.

Offering customer financing also taps into the psychology of purchasing. Customers are always weighing the perceived value of a product against the cost.

High upfront costs create hesitation or even a “sticker shock” effect, where the initial price feels overwhelming.

Financing options like BNPL eliminate this barrier by breaking costs into smaller, more digestible payments. This psychological shift makes premium products or larger orders feel more attainable.

For example, a customer sees a $1,200 laptop they want, but the price feels too high to pay all at once. Now, offer them financing — $100 per month for 12 months. Suddenly, the $1,200 laptop that seemed out of reach becomes affordable with monthly payments of $100.

Types of Customer Financing Solutions for Small Businesses

Customer financing is divided into two primary categories: in-house and third-party.

1. In-House Financing

With in-house financing, the business itself acts as the lender. You offer your customers the option to pay in installments while managing the entire process, from credit checks to payment collections.

This gives you full control over the financing terms and allows you to develop a closer relationship with your customers.

However, the added responsibility also comes with risks and logistical challenges.

Pros of in-house financing

- Complete control over financing terms and customer service.

- Opportunity to generate additional income from interest on payment plans.

- Direct relationship with customers, fostering loyalty.

Cons

- Higher administrative burden—requires software, staffing, and collections management.

- Risk of bad debt if customers fail to make payments.

- Compliance with legal and regulatory requirements adds complexity.

When managing in-house financing, staying organized with payments is key. The right accounting software for small businesses can make this much easier.

2. Third-Party Financing

Third-party financing is a simpler solution. It involves partnering with external companies that specialize in consumer financing.

Providers like PayPal Pay Later, Zip/Quad Pay, Afterpay, and Klarna act as the lenders, taking on the risk and responsibility for payments.

They handle the entire process, including credit checks, payment collections, and customer service management.

Pros of third-party financing

- Immediate payment to your business, as the third-party provider covers the cost upfront.

- No need to manage collections or legal compliance—the provider handles this.

- Quick setup, making it ideal for businesses that want to implement financing solutions without much investment.

Cons

- The provider charges transaction fees, which can reduce your profit margins.

- Less control over customer interactions and financing terms.

- Your reputation can be affected by the third-party provider’s service quality.

Alternative Options for Customer Financing

In-house and third-party financing are popular choices for customer financing, but you can explore these other effective alternatives.

1. Layaway Plans

Layaway programs allow customers to reserve items by making a down payment and then paying the remaining balance in installments over time.

The product is only delivered once full payment is made, reducing the business’s risk.

This option is useful if you sell higher-ticket items and helps prevent product loss before full payment.

Advantages

- No risk of bad debt, as the product is not released until payment is completed.

- It works well for customers who prefer to pay over time without incurring interest charges.

- Unlike credit cards, layaway plans do not charge interest on the remaining balance, making them a cost-effective option for consumers.

Disadvantages

- Can slow down revenue generation, as businesses must wait until the final payment to deliver the product.

2. Credit Card Payments

If you find formal financing programs expensive or unsuitable, simply accepting credit card payments can also offer flexibility.

Customers may opt to finance their purchases through their credit card provider’s installment plan.

Advantages

- Immediate payment to the business.

- No need to manage customer payment plans or credit checks.

Disadvantages

- Credit card transaction fees can be high, reducing profit margins.

- You have no control over interest rates or payment terms determined by credit card issues.

3. Subscription Models

In a subscription model, you offer products or services on a recurring payment basis. Customers are billed weekly, monthly, or annually.

Software-as-a-service (SaaS) businesses commonly use this model, but it is increasingly being applied in industries like food, beauty, and fitness.

Advantages

- Steady, predictable cash flow through regular payments.

- Acquiring new customers is expensive; thus, retaining existing subscribers through a subscription model reduces marketing costs significantly.

- Subscription services often lead to lower customer churn rates.

Disadvantages

- It is unsuitable for all business types, particularly those with one-off purchases.

- Requires careful management of recurring billing and customer service.

4. Medical Credit Cards & Specialized Financing

Businesses in the healthcare sector can offer specialized financing through medical credit cards.

These cards allow patients to finance treatments and pay over time, working similarly to traditional credit cards but often with more favorable terms.

Advantages

- Targeted financing that meets the needs of specific industries like healthcare.

- Often provides lower interest rates than general-purpose credit cards.

Disadvantages

- Limited to certain industries and may require customers to meet specific credit score criteria.

Best Third-Party Financing Options for Small Businesses

You can offer flexible payment plans with third-party financing services without managing credit checks, collections, or financing processes in-house.

They streamline operations and help convert hesitant shoppers into loyal customers.

Below are some of the best third-party financing options for small businesses:

1. PayPal Pay Later

PayPal Pay Later is a suite of buy now, pay later (BNPL) financing options offered by PayPal that allow customers to split purchases into interest-free installments.

The service is included with PayPal Checkout at no additional cost.

With PayPal Pay Later, your customers can choose between two main installment options:

- Pay in 4

- Pay Monthly

Pay in 4 is perfect for smaller transactions. Customers can divide their purchase into four equal, interest-free payments over six weeks. The first payment is due at checkout, and the remaining installments are spread out every two weeks.

Pay in 4 features include:

- Purchases from $30 to $1,500

- 4 payments over 6 weeks

- No sign-up or late fees

- Customers can pay using debit cards, credit cards, or a confirmed bank account.

Pay Monthly is for larger purchases between $199 and $10,000. Your customers can split payments over six, twelve, or even twenty-four months. While this plan isn’t interest-free, with APRs ranging from 9.99% to 35.99%, it allows for more flexibility on higher-cost items, making bigger purchases more feasible.

Customers can choose the payment term that best suits their budget, giving them more control over their expenses.

Pay monthly features include:

- Purchases from $199 to $10,000

- 6, 12, or 24 monthly installments

- No sign-up or late fees

- Customers can optionally enroll in autopay at the time of purchase or any time after

From a business standpoint, PayPal Pay Later’s biggest advantage is that you receive the full payment upfront, regardless of the plan your customer chooses.

Other key advantages include:

- Increases order value: On average, PayPal Pay Later increases the order value by 20% for small to medium-sized retailers compared to standard PayPal transactions. This is because installment options make purchases more affordable for customers.

- Boosts sales: Offering flexible payment options will help drive conversions and improve customer loyalty. 62% of PayPal Pay Later users report that it increases their likelihood of purchasing.

- Immediate payment for merchants: You receive full payment at checkout, while PayPal handles all the billing and collections from the customer, simplifying your operations.

- Drives customer loyalty: PayPal Pay Later has a 67% repeat buyer rate, meaning offering this option can help you cultivate long-term relationships with your customers.

PayPal Pay Later also includes dynamic messaging. This feature automatically promotes installment payment options to customers throughout their shopping journey.

It’s easy to set up and has been shown to increase sales by 6% for small and medium-sized businesses after just three months.

Integrating PayPal Pay Later into your e-commerce platform is straightforward. It’s available on popular platforms like BigCommerce, WooCommerce, Wix, GoDaddy, and Adobe.

Once you’ve set up PayPal Checkout, Pay Later options are automatically presented to customers when applicable, and all new offers are updated automatically without additional configuration.

Note: PayPal Pay Later offers numerous benefits, but there is potential for increased chargebacks or disputes when offering these financing options. Familiarize yourself with PayPal’s policies and procedures for handling such situations.

2. Klarna

As one of the most popular BNPL providers globally, Klarna has 85 million shoppers and 575,000 retail partners.

With Klarna, you can offer customers three main payment solutions:

- Pay in 4

- Pay in 30 Days

- Financing

Pay in 4 allows customers to split their purchase into four equal payments, with the first payment made upfront and the remaining three collected automatically every two weeks. This option is interest-free and ideal for customers who want to manage their payments without any additional costs.

For larger purchases, Klarna Financing offers extended payment plans. Customers can spread their payments over 6 to 36 months. The flexibility of Klarna’s financing options helps increase average order value, with businesses seeing a 41% boost in order value and a 30% increase in conversion rates.

Klarna says when you become a partner, they will help by “continually driving new customers to you from their app, website, and other channels.”

Klarna’s flexible payment options improve the customer experience and have a significant impact on your business performance:

- 41% increase in average order value: Shoppers who use Klarna’s payment plans tend to spend more, boosting their sales.

- 30% increase in conversion rates: Klarna makes it easier for customers to complete their purchases, reducing cart abandonment.

- Up to 40% of Klarna sales come from new customers: Klarna’s wide-reaching marketing efforts drive new customers to your business through their app, website, and affiliate channels.

Klarna also offers performance-driven marketing solutions to turn high-intent shoppers into loyal customers.

They do this through AI-powered technology that delivers shoppable content and optimized campaigns personalized for each user.

Klarna says businesses using their services have seen a 70% increase in revenue and a 25% improvement in return on ad spend.

Their marketing power extends to their highly engaged customer base, where 70% of shoppers are from the Gen Z and Millennial demographics—two groups with higher purchase frequency and brand loyalty.

Klarna’s seamless shopping experience, combined with dynamic messaging at checkout, encourages customers to complete purchases by reminding them of flexible payment options available on your site.

Integrating Klarna with your e-commerce platform is also quick. Klarna’s API integrations and partner platforms help you integrate with Shopify, WooCommerce, BigCommerce, or other major platforms.

Additionally, Klarna provides ready-made marketing assets, such as on-site messaging, to promote its payment options to your customers.

Klarna also provides Seller Protection, assuming all credit and fraud risk.

3. Afterpay

With Afterpay, your customers can split their payments into four interest-free installments over six weeks or choose a monthly payment plan for larger purchases.

The payments are automatically deducted from their linked debit or credit card.

Once integrated into your site, customers can choose Afterpay at checkout — online, in-store, or through the app.

As a business, you receive the full payment upfront in just 1-2 business days, regardless of your customer’s chosen plan.

Additionally, Afterpay helps drive new customers to your brand by featuring your business in the Afterpay app. It’s a key tool for increasing visibility among BNPL shoppers.

Once your business is listed, you’ll have access to 24 million active global customers who regularly use Afterpay to shop at their favorite retailers.

Here are more ways Afterpay benefits your business:

- Acquire new customers: Afterpay helps you reach Millennials and Gen Z customers who shop more frequently and spend more. Adding Afterpay to your payment options gives you access to a broader customer base that is actively looking for flexible payment solutions.

- Increase average order value (AOV): Merchants who use Afterpay see an average 58% increase in order values. Customers are more willing to make larger purchases when given the option to pay in installments.

- Boost conversion rates: Offering BNPL options at checkout reduces cart abandonment, making it easier for customers to complete purchases. Afterpay has delivered $8.6 billion in incremental sales to U.S. merchants in the past 12 months alone.

Afterpay also integrates with all major e-commerce and payment providers, such as Shopify, WooCommerce, BigCommerce, and Stripe.

The setup process is quick and easy.

Additionally, Afterpay offers a Business Hub, a streamlined dashboard that helps you manage your daily workflows. You can access rich audience data, behavioral insights, and a full overview of your Afterpay shoppers through the hub.

4. Affirm

Affirm offers a unique advantage through the Adaptive Checkout™ feature. It’s a system that dynamically offers a variety of personalized payment options tailored to each transaction.

Customers can choose between four interest-free payments every two weeks or longer-term installment plans of up to 36 months, depending on the purchase amount.

This flexibility ensures customers find a plan that suits their budget.

Early adopters of Adaptive Checkout have reported significant benefits, including an average 26% increase in cart conversion rates, a 22% lift in approval rates, and a 20% boost in overall sales.

Here’s how Affirm benefits your business:

- Attract high-intent shoppers: Affirm taps into a network of engaged customers, many of whom say they wouldn’t have made a purchase without the option of flexible payments.

- Boost average order values: Merchants using Affirm have seen a significant lift in average order values, with some reporting an increase of over 85%.

- Reduce cart abandonment: Offering Affirm as a payment method reduces cart abandonment rates, as customers are more likely to complete their purchase when given the option to pay over time. Affirm boasts fewer abandoned carts than any other BNPL provider.

- Increase repeat business: Affirm’s high customer lifetime value (LTV) means that 20% of customers who use Affirm make repeat purchases, driving additional revenue for your business.

When a customer checks out using Affirm, you receive full payment via ACH transfer within 1–3 business days.

Affirm also handles payment plans and communicates with customers through the Affirm app. You don’t deal with the complexities of managing credit or chasing late payments.

5. Splitit

Splitit provides a unique installment payment solution. It allows customers to use their existing credit cards to pay for purchases in interest-free installments without the need for new loans or credit checks.

This Installments-as-a-Service model unlocks unused credit on consumers’ cards, enabling them to split payments into manageable monthly or bi-weekly installments while retaining the benefits of their credit card, such as rewards and transaction protection.

Unlike traditional buy now, pay later (BNPL) services, Splitit does not clutter the checkout experience with additional branding or require complex applications. Instead, it offers a seamless, white-label integration that merchants can easily implement.

Splitit says that it unlocks $3.5 trillion of unused credit in the U.S. market, allowing shoppers to use the credit they’ve already earned without applying for new lines of credit or going through an underwriting process.

With Splitit:

- There are no new applications

- No SSN required

- No friction at checkout

This frictionless experience results in higher conversion rates and less cart abandonment.

Another significant advantage is that Splitit works with any existing credit card, meaning there are no arbitrary purchase limits or hidden fees.

This makes Splitit perfect for businesses selling high-ticket items, as it enables customers to spread payments over time, increasing their purchasing potential.

Merchants using Splitit have seen an average order value (AOV) of over $1,000, much higher than the typical BNPL AOV of $250.

Splitit is embedded directly into your existing checkout process. When a customer chooses to use Splitit, here’s how it works:

- Installment Plan: Customers can choose to split their payments into monthly installments. They don’t need to leave your website or sign up for a separate service.

- Authorization: Splitit authorizes the full purchase amount on the customer’s credit card and reserves the credit balance without charging interest.

- First Installment: The first installment is charged shortly after the purchase authorization or upon product shipment.

- Pay Monthly: Customers are charged monthly until the plan is complete, and they make payments with their existing credit card.

Traditional BNPL solutions often face challenges such as losing control over the customer relationship, low credit approval rates, and regulatory scrutiny.

Splitit solves these issues by allowing customers to use their existing credit card limits. This means no additional credit checks, no new debt, and a lower risk for merchants.

With Splitit, you can offer a variety of flexible payment options depending on your business model and customer needs:

- Pay Monthly: Allow customers to pay in convenient monthly installments.

- Pay Every Two Weeks: Offer more frequent installment payments every two weeks.

- Partial Installments: Enable customers to pay more upfront and split the remaining balance over time.

- Pay on Delivery: Let customers pay for their order in installments after the item has been delivered.

Like others in this list, Splitit integrates easily with all major e-commerce platforms, including Shopify, WooCommerce, Magento, BigCommerce, and more.

No complex setup is required, and once implemented, Splitit can start driving higher average order values and boosting conversions immediately.

Challenges of Offering Customer Financing

Allowing customers to pay in installments can increase average order value and conversions. However, before offering such services, you should also fully understand the risks and operational complexities.

1. Compliance and Regulatory Challenges

Regulatory requirements are one of the first hurdles you’ll face when offering customer financing.

Depending on your location and the nature of the financing service you offer, you need to comply with laws governing credit checks, data privacy, and consumer protection.

For example, businesses operating in the EU must comply with the GDPR, which regulates how customer data is collected and shared.

In the U.S., offering financing will subject your business to scrutiny under the Fair Credit Reporting Act (FCRA) and the Truth in Lending Act (TILA).

And if you’re using third-party financing, you may think compliance is their responsibility, but you still need to ensure their practices meet the necessary regulatory standards. Otherwise, your business could be held liable for violations.

2. Credit Risk and Non-Payment

When offering customer financing, there’s always a risk that some customers may fail to pay on time or default entirely.

This will significantly impact your cash flow, especially if you offer in-house financing.

For small businesses, managing this credit risk is very challenging since defaults can disrupt day-to-day operations.

To mitigate these risks, partner with third-party financing providers, such as Affirm or Klarna. They will handle credit checks and assume the risk of non-payment.

Now, this transfers much of the burden, but depending on the terms you negotiate with the provider, it reduces your profit margins.

3. Cash Flow Management

Offering financing affects your business’s cash flow. How? Instead of receiving full payment at the point of sale, you get paid in installments.

This causes cash flow challenges if you rely on immediate income to cover operational expenses.

To solve this, some third-party financing solutions, like Splitit, provide the full payment upfront while allowing the customer to pay over time.

However, you must have a strong cash flow management system to manage the financing yourself.

Without one, delayed payments will cause a mismatch between your income and expenses, leading to financial strain.

For more tips on keeping your finances in check, check out this guide on managing small business finances.

4. Integration and Technology

When setting up a customer financing system, you’ll need to ensure your website, payment processing systems, and customer relationship management (CRM) tools are all aligned to handle installment payments effectively.

If you’re using a third-party provider, the integration process can vary depending on the platform.

In addition, you’ll need systems in place to track payments, send reminders, and manage potential disputes. This may require upgrading your current infrastructure or investing in new software, adding to the overall cost.

5. Customer Experience and Potential Friction

Poorly executed financing options can lead to a frustrating checkout experience.

Customers may abandon their carts if they face too much friction, such as needing to create an account with a third-party financing provider or going through a complicated approval process.

According to a survey of 6,000 customers by Storyblok, 60% of consumers abandon purchases due to poor website user experience.

To avoid this, choose a financing solution that integrates smoothly with your existing payment process.

Solutions like Affirm and Afterpay reduce friction by offering quick approvals and seamless checkouts but make sure your chosen provider offers a user-friendly experience.

6. Risk of Reputational Damage

If customers have a bad experience with your financing options, it can hurt your brand’s reputation.

Issues like hidden fees, unclear terms, or payment difficulties will frustrate customers and lead to negative reviews.

So, be transparent about the terms and ensure that customers fully understand their repayment obligations upfront.

Conclusion: Why Financing Can Future-Proof Your Business

Offering financing options sets your business up for long-term success.

When you give customers flexible payment choices, you open the door to a wider range of shoppers who might not have considered buying from you otherwise.

Younger customers, especially those familiar with Buy Now, Pay Later options, are more likely to convert when they see installment plans that work for them.

Financing also helps you build stronger relationships with your customers. When they can spread their payments without financial strain, they’re more likely to trust your brand and return for future purchases.

An easier and less stressful buying process → builds loyalty over time.

The best advantage of customer financing is you can offer these benefits without risking your business.

Partnering with third-party financing providers means you get paid upfront while they handle the risk of late payments or defaults. This helps keep your cash flow steady and removes the hassle of managing payment collections.

Frequently Asked Questions: Customer Financing for Small Business

How Can I Offer Finance to My Customers?

You can either set up an in-house financing program where you manage credit terms and collections or partner with third-party financing providers like Affirm or Klarna that handle credit checks and payment processing for you.

What Is Customer Financing in Business?

Customer financing in business refers to the financial services businesses provide that allow customers to purchase goods or services on credit, enabling them to pay over time rather than upfront.

What Is the Best Source of Finance for a Small Business?

The best options include traditional bank loans, Small Business Administration (SBA) loans, lines of credit, and alternative financing solutions like peer-to-peer lending or crowdfunding.

What Is the Most Common Source of Small Business Financing?

The most common source of small business financing is traditional bank loans, which provide capital for various needs such as equipment purchases, operational costs, and expansion efforts. For additional flexibility, alternative financing methods like equipment leasing or invoice factoring are also options.

How Does Customer Financing Work?

Customer financing allows consumers to make purchases and pay for them over time through installment plans or credit options. Businesses can offer these plans directly or through third-party lenders.