Key Takeaways

Cryptocurrency IRAs offer potential for high returns. For example, Bitcoin has shown a CAGR of 165% over the past 5 years, significantly outperforming traditional assets like gold and the S&P 500.

Self-Directed IRAs allow you to hold cryptocurrencies in tax-advantaged accounts, with some providers offering access to over 50 different cryptocurrencies.

Not all cryptocurrencies can be held in an IRA; availability depends on the custodian’s policies and compliance with IRS regulations.

Tax benefits of crypto IRAs can be substantial: a $10,000 investment in Ethereum growing to $30,000 in a Roth IRA could potentially be withdrawn tax-free in retirement.

Early withdrawals from crypto IRAs before age 59½ typically incur a 10% penalty, in addition to applicable taxes, emphasizing the importance of long-term strategy.

Transaction fees for crypto IRAs can vary by provider and typically range from 1% to 2%, along with platform and custodian fees.

According to the 2022 Investopedia Financial Literacy Survey, many younger generations are already factoring cryptocurrency into their retirement strategies.

An impressive 28% of millennials expect to use cryptocurrency to support themselves in retirement, placing it on par with traditional savings (25%) and stock market investments (27%).

This trend isn’t limited to millennials, either. Twenty percent of Gen X and seventeen percent of Gen Z respondents expressed similar intentions.

These statistics paint a clear picture: as portfolios evolve with technology, so too are retirement plans.

While traditional income sources like 401(k)s and Social Security remain predominant, cryptocurrency has firmly established itself on the shortlist of expected retirement funding sources.

This shift raises important questions:

What exactly are cryptocurrency retirement accounts?

What benefits and risks do they present?

And how can interested investors get started?

Table of Contents

What Are Cryptocurrency Retirement Accounts?

Cryptocurrency retirement accounts, often called Bitcoin IRAs or crypto IRAs, are specialized self-directed Individual Retirement Accounts (IRAs) that allow you to invest in digital assets alongside traditional investments.

These accounts marry the tax advantages of conventional IRAs with the potential high growth and diversification benefits of cryptocurrencies.

A crypto IRA lets you hold Bitcoin, Ethereum, and other approved digital currencies in a tax-advantaged retirement account.

You benefit from the appreciation of these digital assets while enjoying the same tax benefits as traditional or cryptocurrency Roth IRA, depending on your chosen account type.

While crypto IRAs share some similarities with conventional retirement accounts, there are crucial differences you should be aware of:

Investment Options: Unlike traditional IRAs that limit you to stocks, bonds, and mutual funds, crypto IRAs allow you to invest in various digital assets.

Volatility: Cryptocurrency investments are more volatile than traditional assets, which can lead to higher potential returns but also greater risk.

Custody: With crypto IRAs, your digital assets are held by specialized custodians who manage the secure storage of your cryptocurrencies.

Fees: Crypto IRAs often come with higher fees due to the complexity of securely storing digital assets and the specialized nature of these accounts.

Regulatory Environment: The rules governing crypto IRAs are still evolving, which can lead to changes in how these accounts are treated from a tax and regulatory standpoint.

Benefits of Including Cryptocurrencies in Your Retirement Portfolio

Since cryptocurrencies operate independently without being tied directly to the stock market’s performance, they might not lose as much value when the markets get rough.

Cryptocurrencies offer a unique opportunity to diversify your retirement portfolio with alternative investments. These include assets beyond traditional options like stocks, bonds, and mutual funds, such as real estate, private equity, precious metals, and cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Furthermore, because certain cryptocurrencies are only available in limited amounts, people often see them as a good way to protect against rising prices over time.

However, it’s crucial to understand these benefits in detail to make an informed decision about their role in your retirement strategy.

1. Use Them to Boost Your Returns with Crypto’s High Growth Potential

Cryptocurrencies have demonstrated unprecedented growth rates, outpacing traditional assets by significant margins.

Bitcoin, for instance, has shown a CAGR of 165% over the past 5 years, significantly outperforming traditional assets like gold and the S&P 500.

While past performance doesn’t guarantee future results, this growth trajectory illustrates the potential for substantial returns.

The reasons behind this growth potential are multifaceted:

Scarcity: Many cryptocurrencies, like Bitcoin, have a fixed supply, creating scarcity that can drive up value as demand increases.

Technological innovation: Blockchain technology continues to evolve, creating new use cases and potential value propositions.

Increasing institutional adoption: Major companies and financial institutions increasingly invest in and accept cryptocurrencies, driving up demand and legitimacy.

For retirement planning, this growth potential could significantly impact your long-term savings.

Consider a scenario where you allocate just 5% of your retirement portfolio to cryptocurrencies.

If this portion experiences substantial growth over the years, it could offset lower returns from more conservative investments, boosting your overall retirement savings.

However, you should understand that this high growth potential comes with increased volatility.

The crypto market has experienced several boom-and-bust cycles.

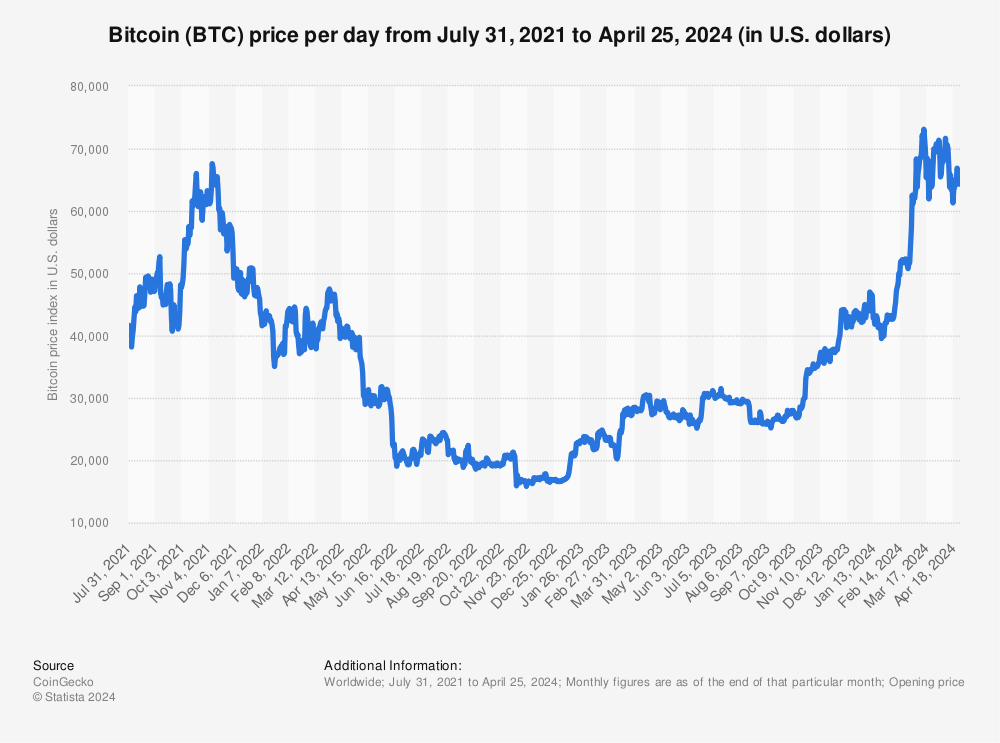

For instance, in 2022, Bitcoin started the year strong, reaching a high of approximately $48,086 in March 2022.

However, it faced a steep decline, dropping to a low of around $15,599 by the end of the year. This marked a significant decrease from its all-time high of nearly $69,000 in November 2021, only to reach new highs of $42,258 by the end of 2022.

This volatility underscores the importance of a long-term perspective and careful portfolio allocation when including cryptocurrencies in your retirement strategy.

2. Diversify Your Portfolio Beyond Stocks and Bonds

Diversification is a sound investment strategy, and cryptocurrencies offer a unique opportunity to diversify your retirement portfolio further.

Traditional diversification involves spreading investments across asset classes like stocks, bonds, and real estate.

Cryptocurrencies introduce an entirely new asset class with distinct characteristics.

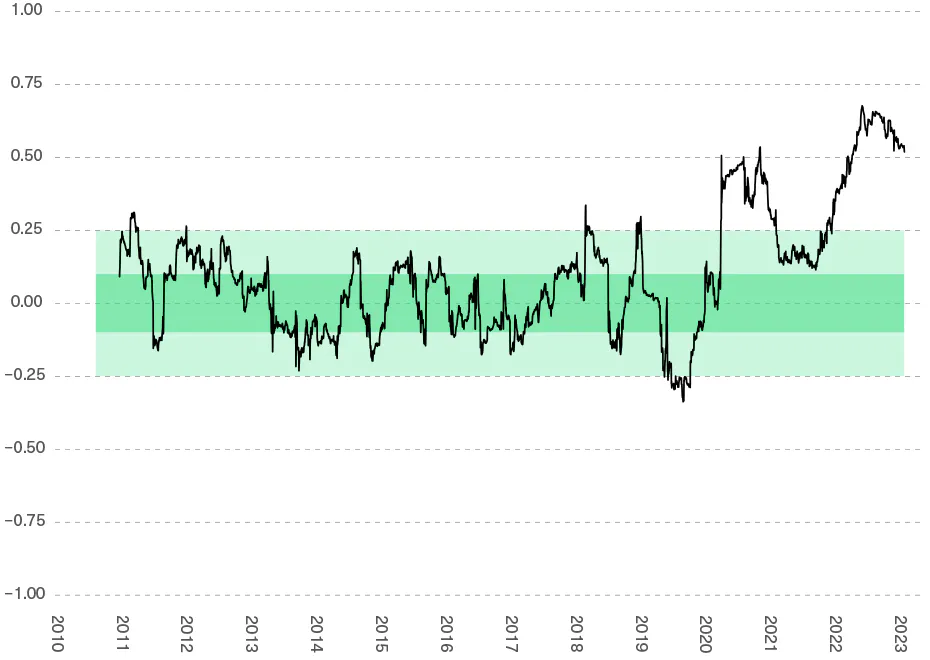

The key benefit of including cryptocurrencies in your diversification strategy lies in their low correlation with traditional assets.

For example, more recent data from Bitwise Asset Management shows that the correlation between Bitcoin and the S&P 500 has risen significantly.

However, they predicted that as of the end of 2023, the correlation coefficient would be at a low of 0.25.

This means that cryptocurrency prices often move independently of stock market trends.

This low correlation can have several positive effects on your portfolio:

Risk reduction: When one asset class underperforms, another may offset the losses.

Improved risk-adjusted returns: By including assets with low correlation, you can achieve better returns for the same level of risk.

Protection against systemic risks: Cryptocurrencies operate on decentralized networks, potentially offering a hedge against risks in the traditional financial system.

For instance, during the March 2020 market crash due to the COVID-19 pandemic, while the S&P 500 dropped by about 30%, Bitcoin, after an initial drop, recovered quickly and ended the year with substantial gains.

This demonstrates how cryptocurrencies can provide a cushion during traditional market downturns.

However, the crypto market can experience periods of correlation with traditional markets, especially during extreme economic stress.

Therefore, while cryptocurrencies offer diversification benefits, they should be part of a broader, well-balanced retirement portfolio.

3. Protect Your Savings from Inflation with Digital Assets

Inflation is a significant concern for retirement planning, as it can erode the purchasing power of your savings over time.

Cryptocurrencies, particularly Bitcoin, have been touted as a potential hedge against inflation, similar to gold.

This perspective is rooted in several key factors:

Fixed supply: Many cryptocurrencies, like Bitcoin, have a capped supply. Bitcoin’s supply is limited to 21 million coins, with new issuance halving approximately every four years. This scarcity contrasts sharply with fiat currencies, which can be printed indefinitely.

Decentralization: Cryptocurrencies are not controlled by any central authority, making them resistant to monetary policies that could lead to inflation.

Global acceptance: As cryptocurrencies gain wider acceptance, they could serve as a store of value independent of any single country’s economic policies.

Historical data provides some support for this inflation-hedge theory.

For example, during periods of high inflation in countries like Venezuela and Zimbabwe, local interest in Bitcoin spiked as people sought to preserve their wealth.

In more stable economies, Bitcoin has often outpaced inflation rates significantly.

For example, during the inflation surge in 2021 and 2022, Bitcoin’s price reached new highs, reflecting its appeal as an inflation-resistant asset.

The inflation-hedging properties of cryptocurrencies are still theoretical and untested over very long periods.

The high volatility of cryptocurrencies can sometimes overshadow their potential as an inflation hedge in the short term.

Therefore, while cryptocurrencies offer inflation protection, they should be considered part of a diverse inflation-hedging strategy that might include traditional hedges like TIPS (Treasury Inflation-Protected Securities) or real estate.

4. Get Ahead by Adopting Tomorrow’s Financial Technology Today

Blockchain technology, which underpins most cryptocurrencies, is increasingly being adopted across various industries, from finance to supply chain management.

You’re gaining exposure to this transformative technology by including cryptocurrencies in your retirement portfolio.

This can have several long-term benefits:

Early adoption advantage: As blockchain technology becomes more mainstream, early adopters may benefit from increased valuations of their crypto assets.

Future-proofing your portfolio: The financial landscape is rapidly evolving. By familiarizing yourself with crypto now, you’re preparing for a future where digital assets may play a much larger role in the global economy.

Potential for passive income: Some cryptocurrencies offer staking rewards or yield farming opportunities, which could provide passive income in retirement. For example, Ethereum’s shift to a Proof-of-Stake model allows holders to earn rewards for validating transactions.

Access to innovative financial products: The decentralized finance (DeFi) ecosystem built on blockchain technology creates new financial products and services. Early exposure to this sector could provide access to innovative retirement planning tools in the future.

Risks Associated with Cryptocurrency Retirement Accounts

With cryptocurrencies being really up and down, there’s a chance for potential losses, especially if you’re looking at the short term.

On top of that, with all the rules around crypto IRAs always changing, things can get tricky for you.

When considering a cryptocurrency retirement account, it’s crucial to choose reputable Bitcoin IRA companies. These companies should offer advanced security measures, transparent fee structures, and partnerships with reputable custodians and insurers to ensure the safety and management of your digital assets.

Before jumping in headfirst, think hard about these risks:

1. Be Prepared for Wild Price Swings in Your Crypto Investments

Cryptocurrency markets are notorious for extreme volatility, which can significantly affect your retirement account.

Unlike traditional assets such as stocks or bonds, cryptocurrencies can experience dramatic price fluctuations within very short periods.

This volatility can be attributed to several factors:

Market immaturity: The cryptocurrency market is still relatively young and lacks the depth and liquidity of more established markets.

Speculative trading: A significant portion of crypto trading is speculative, leading to rapid buy and sell cycles that can cause sharp price movements.

News sensitivity: Cryptocurrency prices can react dramatically to news events, regulatory announcements, or even tweets from influential figures.

To illustrate the extent of this volatility, consider Bitcoin’s price history:

2017: Bitcoin’s price hovered around $1,000 until mid-2017, when it surged to nearly $20,000 by December 2017, only to experience a significant correction in 2018, closing the year around $3,800.

COVID-19 Impact: In 2020, Bitcoin opened at $7,161 and closed the year at $28,993, marking a 416% increase as it recovered rapidly from an initial drop during the pandemic.

2021: Bitcoin reached an all-time high of nearly $69,000 in November 2021, followed by a sharp decline in 2022, dropping to approximately $15,599 by the end of the year.

2022: In November 2022, Bitcoin recorded a 10-day volatility of more than 100%, highlighting the extreme price fluctuations during this period.

Current Trends: As of early 2024, Bitcoin continues to exhibit high volatility, with 60-day volatility measured at 4.7% and ongoing fluctuations in price reflecting its status as one of the most volatile assets available for investment.

Such extreme fluctuations can have severe implications for retirement planning.

If you need to withdraw funds from your cryptocurrency retirement account during a market downturn, you might be forced to sell at a significant loss.

This sequence-of-returns risk is particularly dangerous for retirees or those nearing retirement, as there may not be enough time to recover from substantial losses.

Moreover, the psychological impact of such volatility shouldn’t be underestimated.

The stress of watching your retirement savings fluctuate wildly can lead to panic selling or other emotionally driven investment decisions that may be detrimental to your long-term financial health.

2. You’ll Need to Navigate the Uncertain Regulatory Landscape of Crypto IRAs

The regulatory environment surrounding cryptocurrencies and crypto IRAs is still evolving, creating a layer of uncertainty for investors.

Unlike traditional retirement accounts, which operate under well-established regulations, the rules governing cryptocurrency investments in retirement accounts are less clear and potentially subject to change.

In the United States, the regulatory framework is fragmented, with multiple agencies involved, including the SEC, CFTC, and IRS.

This complexity can lead to confusion for investors regarding compliance and reporting requirements

This regulatory uncertainty poses several risks:

Potential for restrictive regulations: Governments and regulatory bodies worldwide are still grappling with how to regulate cryptocurrencies. There’s a risk that future regulations could restrict or even prohibit the use of cryptocurrencies in retirement accounts.

Tax implications: The tax treatment of cryptocurrencies is complex and can change. For example:

In the United States, the IRS currently treats cryptocurrencies as property for tax purposes, but this classification could change.

The tax implications of mining, staking, or receiving airdrops within a crypto IRA are not always clear and could lead to unexpected tax liabilities.

Compliance challenges: As regulations evolve, crypto IRA providers and investors may face challenges in ensuring compliance with new rules. This could lead to increased costs or even the need to restructure investments.

In 2023, the IRS clarified that staking rewards must be included in gross income for the taxable year when the taxpayer acquires “dominion and control” over the tokens. This means that the rewards are taxable when the taxpayer can sell or transfer them, which can create confusion regarding the timing of tax liabilities for investors.

3. Digital Assets Are Vulnerable to Cybersecurity Threats

Cryptocurrencies are vulnerable to various cyber threats.

The risks in this area are multifaceted and potentially severe:

Hacking: Cryptocurrency exchanges and wallets can be targets for hackers.

Phishing attacks: Cybercriminals often use sophisticated phishing techniques to trick investors into revealing their private keys or login credentials.

Smart contract vulnerabilities: For cryptocurrencies and tokens built on platforms like Ethereum, vulnerabilities in smart contract code can lead to loss of funds.

Loss of access: If you lose your private keys or recovery phrases, you could permanently lose access to your cryptocurrency holdings. There’s often no central authority that can help you recover lost crypto assets.

The implications of these security risks for retirement accounts are significant.

A successful cyber attack could result in the complete loss of your crypto retirement savings, with little to no recourse for recovery.

This is concerning for retirees or those nearing retirement, as they have less time to recoup such losses.

To mitigate these risks, crypto IRA providers often employ advanced security measures:

Cold storage: Storing the majority of assets offline in hardware wallets.

Multi-signature wallets: Requiring multiple approvals for transactions.

Insurance: Some providers offer insurance coverage against theft or loss.

However, it’s crucial to understand that these measures, while helpful, don’t eliminate the risk entirely.

You must remain vigilant and educated about best practices for cryptocurrency security.

4. Lack of Traditional Protections for Crypto Investments

Cryptocurrency investments, including those in retirement accounts, often lack the protections and insurance that come with traditional financial products.

This absence of safeguards introduces additional risks:

No FDIC or SIPC insurance: The FDIC insures bank deposits up to $250,000 per depositor, while the SIPC protects customers of brokerage firms in the event of a firm’s bankruptcy, covering up to $500,000 in securities and cash. However, cryptocurrencies are not covered by Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation (SIPC) insurance. This means that if a crypto exchange or custodian fails, you could lose your entire investment.

Limited consumer protections: The cryptocurrency market lacks many of the consumer protections found in traditional financial markets. For instance:

There’s no centralized authority to turn to for dispute resolution.

Market manipulation is more common and harder to detect or prevent in crypto markets.

Irreversibility of transactions: Most cryptocurrency transactions are irreversible. If you accidentally send crypto to the wrong address or fall victim to a scam, there’s often no way to recover your funds.

Custody risks: When using a crypto IRA, you’re often relying on a third-party custodian to securely store your assets. If the custodian faces financial difficulties or engages in fraudulent activities, your retirement savings could be at risk.

The Terra/Luna collapse in May 2022 serves as a stark reminder of these risks.

Investors lost billions of dollars as the value of Terra and its associated token Luna plummeted to near zero in a matter of days.

Numbers show that investors lost more than $7 billion on this coin.

Many investors who had significant portions of their savings in these tokens, including in retirement accounts, saw their investments evaporate with little recourse.

5. Challenges in Long-Term Value Assessment

Assessing the long-term value of cryptocurrencies presents unique challenges, particularly in the context of retirement planning:

Lack of historical data: Most cryptocurrencies have only existed for a little over a decade, providing limited historical data for long-term performance analysis. This makes it difficult to project future returns or assess long-term viability.

Technological obsolescence: The rapid pace of technological advancement in the crypto space means that current leading cryptocurrencies could potentially be replaced by superior technologies in the future.

Difficulty in fundamental analysis: Unlike stocks, where you can analyze company financials and performance, cryptocurrencies often lack traditional valuation metrics. This makes it challenging to determine their intrinsic value.

Network effects and adoption rates: The value of many cryptocurrencies is heavily dependent on network effects and adoption rates, which can be unpredictable over long time horizons.

For retirement planning, which involves a time horizon of decades, these factors introduce significant uncertainty.

It’s challenging to determine whether a cryptocurrency that’s popular today will still be relevant or valuable in 20 or 30 years.

What is Self-Directed IRA for Cryptocurrency?

A Self-Directed IRA (SDIRA) is a type of Individual Retirement Account that gives you more control over your investment choices.

Unlike traditional IRAs, which limit you to a selection of stocks, bonds, and mutual funds, an SDIRA allows you to invest in a wider range of assets, including:

Real estate

Precious metals

Private company stock

Cryptocurrencies

The “self-directed” aspect refers to your ability to make investment decisions, rather than relying on a custodian to choose investments for you.

However, while you direct the investments, you don’t directly handle the assets.

When it comes to cryptocurrency, a Self-Directed IRA functions as a wrapper that allows you to hold digital assets within a tax-advantaged retirement account. A Bitcoin IRA company enables individuals to invest in cryptocurrencies within their IRA and provides custodial services to securely manage digital assets, often utilizing advanced security measures.

Here’s how it works:

Account Setup: You establish a Self-Directed IRA with a custodian that allows cryptocurrency investments.

Funding: You fund the account, either through a contribution (subject to annual limits) or by rolling over funds from an existing retirement account.

Cryptocurrency Purchase: The custodian, following your direction, uses the funds to purchase cryptocurrencies through a partnered exchange.

Storage: The acquired cryptocurrencies are stored securely, usually in a combination of hot (online) and cold (offline) wallets, managed by the custodian or a third-party storage provider.

Ongoing Management: You can direct further purchases, sales, or transfers of cryptocurrencies within the account, always working through the custodian.

Tax Benefits of Cryptocurrency Retirement Accounts

Cryptocurrency retirement accounts, particularly when structured as Individual Retirement Accounts (IRAs), offer significant tax advantages that can potentially enhance your long-term wealth accumulation, similar to those of traditional and Roth IRAs.

These benefits, similar to those of traditional retirement accounts, are designed to incentivize long-term savings and investment.

However, when applied to the high-growth potential of cryptocurrencies, they can lead to substantial tax savings and wealth preservation.

Let’s delve into the specific tax benefits of cryptocurrency retirement accounts and how they can impact your overall financial strategy.

1. Tax-Deferred Growth in Traditional Cryptocurrency IRAs

One of the primary benefits of a traditional cryptocurrency IRA is tax-deferred growth.

This means that any capital gains, dividends, or interest generated within the account are not subject to immediate taxation.

Instead, taxes are deferred until you make withdrawals from the account, typically in retirement. This tax deferral can have a powerful effect on your wealth accumulation over time.

Here’s how tax-deferred growth benefits your cryptocurrency investments:

Compound Growth: By deferring taxes, you allow your full investment, including what would have been paid in taxes, to continue growing. This can lead to significantly larger account balances over time due to the power of compound growth.

Tax Bracket Management: Since you don’t pay taxes on the gains until withdrawal, you can potentially manage your tax liability by timing your withdrawals strategically in retirement when you might be in a lower tax bracket.

Reinvestment of Gains: In a taxable account, you might need to sell some assets to pay taxes on your gains each year. In a tax-deferred account, all gains can be reinvested, potentially leading to greater long-term growth.

For example, if you invested $10,000 in Bitcoin within a Bitcoin IRA and it grew to $100,000 over several years, you wouldn’t owe any taxes on that $90,000 gain until you start making withdrawals.

This allows your investment to grow unencumbered by annual tax obligations.

2. Tax-Free Growth with Roth Cryptocurrency IRAs

Roth cryptocurrency IRAs offer a different, but equally powerful, tax advantage: tax-free growth.

With a Roth IRA, you contribute after-tax dollars, but all subsequent growth and qualified withdrawals in retirement are completely tax-free.

The benefits of tax-free growth in a Roth cryptocurrency IRA include:

Maximized Returns: All of your investment gains, no matter how large, can be withdrawn tax-free in retirement. This can be especially beneficial if you expect cryptocurrency values to increase significantly over time.

Hedge Against Future Tax Rates: If you believe tax rates will be higher in the future, paying taxes now at your current rate and enjoying tax-free withdrawals later can be advantageous.

No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs don’t require you to start taking distributions at age 72, allowing your investments to continue growing tax-free for as long as you choose.

Consider a scenario where you invest $10,000 in Ethereum in a Roth IRA, and over 20 years it grows to $500,000.

In a taxable account, you might owe a significant portion of that gain in capital gains taxes.

In a Roth IRA, you could withdraw the entire $500,000 tax-free in retirement.

3. Tax Benefits for Cryptocurrency Mining and Staking in IRAs

For those involved in cryptocurrency mining or staking, IRAs can offer unique tax advantages.

Typically, income from mining or staking is taxable as ordinary income in the year it’s earned.

However, when these activities occur within an IRA, the tax treatment changes:

In a Traditional IRA: Income from mining or staking grows tax-deferred. You won’t owe taxes on this income until you make withdrawals from the account.

In a Roth IRA: Income from mining or staking can grow completely tax-free. As long as you follow the Roth IRA rules, you won’t owe any taxes on this income, even when you withdraw it in retirement.

This can be beneficial given the ongoing nature of mining and staking rewards, allowing you to compound your earnings without annual tax drag.

4. Mitigating the Impact of Short-Term Capital Gains

Cryptocurrency trading in taxable accounts can lead to significant short-term capital gains taxes, which are taxed at your ordinary income rate.

In a taxable account, short-term capital gains are taxed as ordinary income, which can be as high as 37% depending on your income bracket. By trading within an IRA, you avoid these immediate tax liabilities.

Active Trading: If you engage in frequent cryptocurrency trading, doing so within an IRA can shield you from the tax consequences of short-term gains.

Rebalancing: You can rebalance your cryptocurrency portfolio within an IRA without triggering taxable events.

For active cryptocurrency traders, this benefit can lead to substantial tax savings and simplify tax reporting.

Tax Loss Harvesting Considerations

It’s important to note that while cryptocurrency IRAs offer many tax benefits, they do come with some limitations.

One significant consideration is the inability to take advantage of tax loss harvesting:

In a taxable account, you can sell cryptocurrencies at a loss to offset other capital gains or up to $3,000 of ordinary income per year.

Losses within an IRA cannot be used to offset gains or income outside the account.

This is a trade-off to consider when deciding how to allocate your cryptocurrency investments between taxable accounts and IRAs.

Conclusion

Having a retirement account in cryptocurrency can really change how your money grows over time.

When you add cryptocurrencies to what you already have saved, there’s a chance to make more money and protect yourself from the cost of things going up.

But remember, investing in crypto comes with its ups and downs because prices can change quickly, and rules around it are always evolving.

If you want more say in what happens with your investments, think about getting an IRA where you call the shots. Look into how this could also help lower your taxes.

To get started on this path towards using tomorrow’s tech for your future savings:

Find a trustworthy crypto IRA to look after your account,

Choose different types of cryptocurrencies smartly,

And make sure keeping them safe is top priority.

Set up a cryptocurrency retirement account now and step into an opportunity for growth.

For more tips, subscribe to our newsletter.

Frequently Asked Questions (FAQs)

Can You Hold Any Cryptocurrency in an IRA?

Many self-directed IRAs allow you to hold a variety of cryptocurrencies, including Bitcoin, Ethereum, and other altcoins. However, the specific cryptocurrencies you can hold depend on the custodian managing your IRA. Not all custodians offer the same range of digital assets.

How Do I Transfer Funds from a Traditional IRA to a Cryptocurrency IRA?

Transferring funds from a traditional IRA to a cryptocurrency IRA typically involves a process called a “rollover” or “transfer.” First, you’ll need to open a self-directed IRA with a custodian that supports cryptocurrency investments. Them initiate a trustee-to-trustee transfer from your existing traditional IRA to your new self-directed cryptocurrency IRA.

This direct transfer avoids tax consequences. Once the funds are in the account, the custodian will work with you to invest in cryptocurrencies through a partnered exchange.

The custodian will then securely store the acquired cryptocurrencies, usually in a combination of hot (online) and cold (offline) wallets.

Is a Crypto IRA a Good Investment?

Whether a Crypto IRA is a good investment depends on your individual financial situation, risk tolerance, and retirement goals. Cryptocurrencies offer potential for high returns but come with significant risks due to their volatility and regulatory uncertainties.

Crypto IRAs offer tax-deferred growth in traditional IRAs or potentially tax-free growth in Roth IRAs. This can lead to greater wealth accumulation over time compared to holding crypto in a taxable account.

Can You Have Crypto in a Roth Individual Retirement Account (Roth IRA)?

Yes, you can hold cryptocurrencies in a Roth IRA. While you cannot directly contribute cryptocurrencies to a Roth IRA, you can purchase them through the IRA using cash contributions. The IRA custodian will facilitate the purchase and storage of the digital assets.

Can I Withdraw My Cryptocurrencies from My IRA Before Retirement?

Yes, you can withdraw cryptocurrencies from your IRA before retirement, but it’s generally not advisable due to potential tax consequences and penalties. For a traditional IRA, withdrawals before age 59½ are subject to income tax and typically incur a 10% early withdrawal penalty.

Roth IRA contributions can be withdrawn at any time without penalty, but earnings withdrawn early may be subject to taxes and penalties.

Additionally, some crypto IRA custodians may have their own rules or fees for early withdrawals.