Key Highlights

- Gold Liberty Coins offer a unique investment opportunity, combining historical significance with precious metal value and potential for numismatic appreciation.

The value of Liberty Gold Coins is influenced by factors including gold content, rarity, condition, and historical significance, with high-grade specimens showing significant appreciation potential.

Proper storage, handling, and insurance are crucial for maintaining the condition and value of Liberty Gold Coins.

Tax considerations for Liberty Gold Coin investments are complex, with coins generally classified as collectibles and subject to a 28% long-term capital gains rate.

When selling Liberty Gold Coins, timing, choice of venue, and proper preparation significantly impact returns.

The decision between online and physical dealers involves weighing factors such as convenience, ability to examine coins, pricing, and access to expertise, with many investors adopting a hybrid approach.

Liberty Gold Coins represent a unique intersection of numismatic value and precious metal investment.

These historic coins, minted between 1838 and 1908, have garnered significant attention in recent years due to economic uncertainties and inflationary pressures. In 2023, gold prices reached record highs, with Liberty Gold Coins seeing a corresponding surge in demand among collectors and investors alike.

This comprehensive guide delves into the intricacies of Liberty Gold Coins, offering expert insights on their historical significance, investment potential, and practical considerations for novice and experienced collectors.

Table of Contents

What are Gold Liberty Coins?

Liberty coins are collectible and investment coins that symbolize freedom and independence.

These coins feature iconic imagery, such as depictions of Lady Liberty, which represents the ideals of liberty and democracy. The obverse side of these coins prominently features Lady Liberty, symbolizing freedom and democracy.

There is a stock of scarcer, collectible $10.00 Gold coins available, and pricing information is provided for those interested in purchasing United States $10.00 Liberties.

The most famous examples include the American Liberty series, such as the Liberty Head gold coins and the modern American Eagle coins minted in gold, silver, or platinum.

The History and Significance of Liberty Gold Coins

The story of Liberty Gold Coins is deeply intertwined with pivotal moments in American history.

Minted during an era of rapid expansion and economic transformation, these coins witnessed:

The California Gold Rush (1848-1855), which dramatically increased gold production and circulation

The Civil War (1861-1865), a period that saw significant changes in American currency

The rise of the United States as a global economic power in the late 19th century

The craftsmanship of Liberty Gold Coins is particularly noteworthy.

The United States Mint employed some of the finest engravers, including James B. Longacre and Christian Gobrecht, to create designs that would stand the test of time.

The high-relief versions of these coins, especially the Saint-Gaudens Double Eagle, are considered masterpieces of numismatic art. Augustus Saint-Gaudens, commissioned by President Theodore Roosevelt, played a pivotal role in redesigning American coinage, creating some of the most beautiful and significant coins in U.S. history.

Types of Liberty Gold Coins and Their Characteristics

Liberty Gold Coins come in various denominations and designs, each with unique features. These coins were mint produced by the U.S. Mint, showcasing the craftsmanship and historical significance of American coinage:

Liberty Head Gold Dollars (1849-1889):

Smallest U.S. gold coins ever minted

Three distinct types, with the last featuring a larger, more detailed portrait of Liberty

Liberty Head Quarter Eagles ($2.50) (1840-1907):

The compact size made them popular for everyday transactions

Consistent design throughout its long production run

Liberty Head Half Eagles ($5) (1839-1908):

One of the longest-running designs in U.S. coinage history

Minted at various facilities, including Carson City, adding to collector interest

Liberty Head Eagles ($10) (1838-1907):

The larger size allowed for more intricate design details

Saw significant production during the California Gold Rush

Liberty Head Double Eagles ($20) (1849-1907):

Largest regular-issue gold coins of their time

The final years (1907-1908) saw the introduction of the Saint-Gaudens design

Each type offers unique investment opportunities, with rarer dates and mint marks commanding significant premiums.

Do Liberty Coins Have Legal Tender Status and Government Backing?

Liberty coins, particularly those minted by the United States Mint, have legal tender status and are backed by the U.S. government. This means they can be used as a medium of exchange for debts and purchases.

However, it’s important to distinguish between official U.S. coins and private medallions that may carry the name “Liberty.”

For example, the NORFED “Liberty Dollar” medallions, marketed as an alternative currency, are not genuine U.S. coins and do not have legal tender status.

The U.S. Mint has explicitly warned consumers about these medallions, stating that the government does not back them and their use as currency is considered illegal under federal law.

This government backing provides several advantages:

Intrinsic value: The gold content of these coins is guaranteed by the U.S. government

Collectible status: Their historical significance adds value beyond their gold content

Potential tax benefits: Due to their status as currency, gold coins may be exempt from certain taxes in some jurisdictions. For instance, under the Taxpayer Relief Act of 1997, specific gold coins can be included in Individual Retirement Accounts (IRAs), which can offer tax advantages for investors.

The Value of Liberty Gold Coins

The value of Liberty Gold Coins is a complex interplay of intrinsic gold content and numismatic significance.

This duality creates a unique investment proposition, appealing to precious metal investors and coin collectors.

Understanding the multifaceted nature of these coins’ value is crucial for making informed investment decisions in the current market.

Factors Influencing the Value of Liberty Gold Coins

The market value of Liberty Gold Coins is determined by several key factors that extend beyond their gold content.

Primarily, the coin’s rarity plays a significant role, with mintage numbers varying widely across different years and mint locations.

Condition is another critical factor, often dramatically impacting a coin’s value.

Historical significance adds another layer of value to Liberty Gold Coins. Coins minted during notable events or from prestigious mints often carry substantial premiums.

Market demand, influenced by collector interest and investment trends, is crucial in determining value.

The recent focus on tangible assets has increased demand for high-quality Liberty Gold Coins.

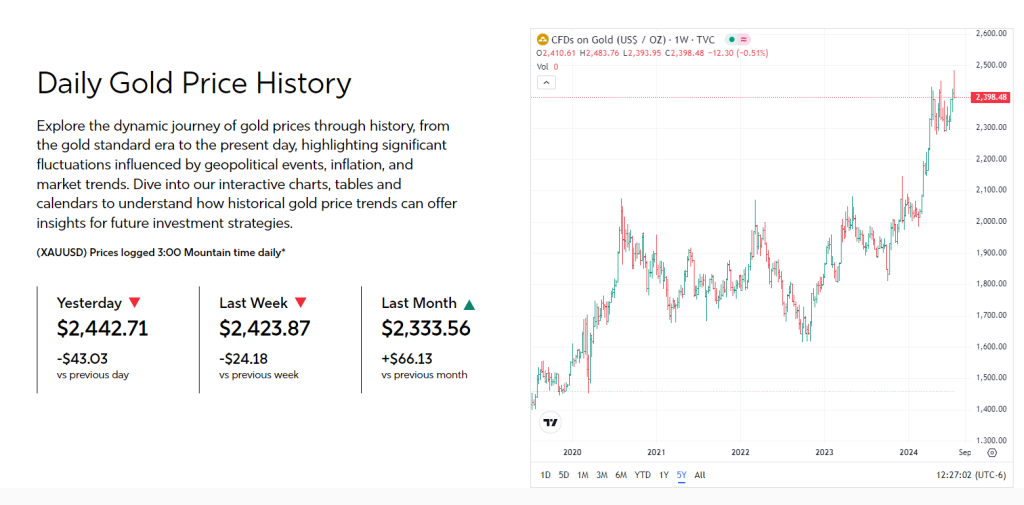

Underlying all these factors is the base value tied to gold content. As of February 2024, with gold prices fluctuating around $2,000 per ounce, the intrinsic value of these coins provides a solid foundation for their overall worth.

Numismatic Value vs. Bullion Value

Liberty Gold Coins possess a dual nature in terms of valuation, encompassing both bullion and numismatic value.

The bullion value is straightforward, based on the coin’s gold content and the current spot price of gold.

This provides a baseline value that fluctuates with the precious metals market.

As of early 2024, a Liberty Head Double Eagle contains 0.9675 ounces of pure gold, giving it a minimum value of around $1,935 at a $2,000/oz gold price.

However, numismatic value is more complex and often significantly exceeds bullion value, especially for rare dates or high-grade specimens.

This value encompasses factors beyond gold content, including rarity, condition, and historical importance.

In 2023, a common date Liberty Head Eagle in circulated condition might sell for 20-30% over its gold value, while a rare date in uncirculated condition could command a premium of 1000% or more.

This significant markup is due to the coin’s rarity, historical significance, and desirability among collectors, which can drive prices much higher than the intrinsic value based solely on gold content.

The interplay between bullion and numismatic value creates a unique investment proposition.

During periods of economic uncertainty, the bullion aspect provides a stable floor, while the numismatic component offers potential for appreciation independent of gold prices.

This dual nature allows investors to hedge against inflation while capitalizing on the collectible coin market’s dynamics.

How Do You Assess Condition and Authenticity?

Accurate grading and authentication are paramount in determining a Liberty Gold Coin’s value.

Professional grading services like PCGS and NGC evaluate coins using the industry-standard Sheldon Scale, which ranges from 1 (Poor) to 70 (Perfect Uncirculated).

Key factors in grading include original mint luster, strike quality, and surface preservation.

Well-struck coins with full details and minimal marks command significantly higher prices in the market.

Authentication processes have become increasingly sophisticated, employing a range of techniques to ensure a coin’s legitimacy:

Weight and measurements must conform to U.S. Mint specifications

XRF analysis confirms correct gold content

Expert examination of mint marks, date placements, and known die varieties

High-resolution imaging technology for detailed, 360-degree analysis

Advanced spectroscopic techniques for detecting surface treatments and alterations with 99.7% accuracy

As the market for Liberty Gold Coins continues to evolve, staying informed about these valuation factors is crucial for anyone considering them as an investment.

The combination of historical significance, precious metal content, and numismatic appeal creates a complex but potentially rewarding market for knowledgeable investors and collectors.

Why Choose Liberty Gold Coins for Investment?

Liberty Gold Coins presents several compelling reasons for investment consideration.

1. They offer a hedge against inflation and economic uncertainty

As fiat currencies face ongoing pressures, the inherent value of gold provides a stabilizing factor in investment portfolios.

In 2023 and 2024, gold prices surged to record highs amid global economic tensions, and Liberty Gold Coins experienced corresponding increases in bullion and numismatic values.

2. The historical significance of these coins adds a layer of value beyond their gold content.

This aspect can lead to price appreciation that outpaces the general gold market, especially for rare dates or exceptional specimens.

3. Liberty Gold Coins offer portfolio diversification benefits

Their performance often correlates poorly with traditional financial assets like stocks and bonds, providing a buffer against market volatility.

This characteristic has become increasingly valuable in recent years as global markets have experienced heightened instability.

4. The tangible nature of these coins appeals to investors seeking physical assets

Unlike paper investments or digital currencies, Liberty Gold Coins offer the security of a physical holding that can be directly possessed and transferred.

This aspect has gained importance in an era of increasing cybersecurity concerns and digital asset vulnerabilities.

5. The collectible aspect of these coins provides enjoyment beyond their investment potential

Many investors enjoy owning pieces of American history, combining their financial goals with numismatic interest.

This dual purpose can enhance the investment experience and lead to a deeper market understanding.

How Do You Build a Portfolio with Liberty Gold Coins?

Constructing a well-balanced portfolio of Liberty Gold Coins requires careful consideration and strategic planning.

As an investor, you should pproach this market with a long-term perspective, as the full potential of these assets often materializes over extended periods.

A diversified Liberty Gold Coin portfolio includes common dates for their bullion value and carefully selected rare specimens for their numismatic potential.

For example, common date Liberty Double Eagles offer a cost-effective way to accumulate gold, while key dates or high-grade examples of scarcer issues provide opportunities for significant appreciation.

When building a portfolio, consider the following:

Various denominations available: Each denomination – from Gold Dollars to Double Eagles – offers different historical contexts and market dynamics. Diversifying across these options can help spread risk and capture various market opportunities.

The condition of the coins is a critical factor in portfolio construction. While high-grade specimens command premium prices, they also offer the greatest potential for appreciation. However, balancing these premium pieces with more affordable, circulated examples can provide a solid foundation for long-term growth.

Also, pay attention to the provenance of their coins. Pieces with documented histories or from notable collections often carry additional value.

While challenging, market timing plays a role in portfolio building. Monitor both the gold market and numismatic trends to identify opportune acquisition moments. For instance, periods of gold price consolidation may present buying opportunities for bullion-focused investors. At the same time, numismatic market dips can allow for acquiring rarer pieces at more favorable prices.

Stay informed about market trends, historical contexts, and numismatic developments for successful portfolio management. Attending coin shows, participating in auctions, and engaging with numismatic publications can provide valuable insights and networking opportunities.

A balanced Liberty Gold Coin portfolio might include:

50-60% common date coins for bullion value and liquidity

30-40% semi-key dates for growth potential

10-20% rare specimens or high-grade examples for maximum appreciation potential

Building a portfolio of Liberty Gold Coins requires patience, knowledge, and strategic planning.

Where to Purchase Liberty Gold Coins

The market for these historical coins has evolved significantly, with traditional and modern purchasing options available to investors and collectors.

Trusted sources for buying liberty gold coins include:

Liberty Coin Service – A well-established dealer in rare coins and precious metals, offering a variety of gold coins, including Liberty Gold Coins. They have been in business since 1971 and provide services for buying and selling gold and silver bullion. They are located in Michigan.

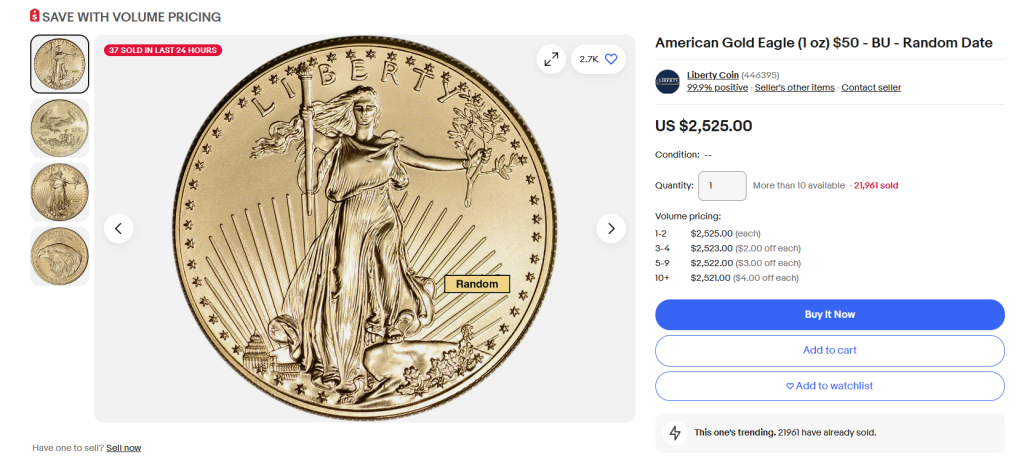

Liberty Coin – This dealer specializes in precious metal bullion, collectible coins, and US Mint products. They carry all US Mint bullion products, including gold, silver, and platinum American Eagles.

DSS Coin & Bullion – A dealer in coins and bullion, offering a selection of gold coins. They also sell jewelry and trading cards or art and antiques.

Gold & Silver Trading Post – Located in Bellevue, Nebraska, this trading post buys and sells gold, silver, coins, jewelry, and other precious metals.

Liberty Gold and Coin Exchange, Inc – They buy and sell various gold coins, including Liberty Gold Coins. They also offer appraisals and assistance with estate resolution.

Liberty Coin & Gold LLC – Specializes in coin, currency, and bullion sales. It also buys old jewelry, Liberty Coins, and Gold.

Golden Eagle Coins – An online dealer offering a selection of Liberty Gold Coins. Opened in 1974, they offer 24/7 services.

Lear Capital – Offers various gold coins, including Liberty Gold Coins, available for online purchase. It’s also a PCGS (Professional Coin Grading Service) authorized dealer.

Regardless of the chosen source, due diligence is essential.

You should verify dealers’ reputations, check for membership in professional organizations like the American Numismatic Association, and ensure that high-value coins are certified by recognized grading services.

Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC) organizations provide unbiased assessments of a coin’s condition, which can significantly affect its value.

Coins graded by these services are encapsulated in protective holders that display their grade, assuring buyers regarding their quality and authenticity.

Summary: The key factors to consider when choosing a source for Liberty Gold Coins include:

Reputation and longevity in the numismatic community

Membership in professional organizations (e.g., PNG, ANA)

Guarantee of authenticity and return policies

Access to certified coins from recognized grading services

Competitive pricing and transparency in fees

Educational resources and customer support

Secure payment and shipping options

Tips on How to Avoid Counterfeit Coins

Unfortunately, the rise in popularity of Liberty Gold Coins has been accompanied by an increase in counterfeit specimens entering the market.

Authentication begins with the seller.

Established dealers with long-standing reputations in the numismatic community are less likely to sell counterfeit coins knowingly.

However, even reputable sources occasionally encounter sophisticated fakes, so educating yourself on authentication methods is crucial.

Weight and measurements are fundamental in detecting counterfeits.

Liberty Gold Coins have specific dimensions and weights that counterfeiters often fail to replicate accurately.

Familiarize yourself with the correct specifications for each denomination and year. Digital scales and calipers have become essential tools for serious collectors and investors.

Visual inspection, while not foolproof, can reveal many counterfeits. Genuine Liberty Gold Coins have distinct features, including sharp striking details, correct font styles, and specific mint marks.

Magnification tools like jeweler’s loupes can help examine these details closely.

The sound of a coin can also indicate its authenticity. Unlike base metal counterfeits, genuine gold coins produce a distinctive ring when tapped.

While this method requires experience, it remains a quick initial test many dealers use.

For high-value purchases, professional authentication is strongly recommended. Third-party grading services employ various advanced technologies, including X-ray fluorescence and ultrasound imaging, to verify a coin’s composition and structure.

You should also be particularly wary of deals that seem too good to be true.

Counterfeiters often price their fakes slightly below market value to attract buyers while making a significant profit. Before purchasing, research current market prices for specific dates and grades thoroughly.

Education remains the best defense against counterfeits.

Attending numismatic seminars, studying reference materials, and handling genuine specimens under expert guidance can significantly enhance your ability to detect fakes.

Common red flags that may indicate a counterfeit Liberty Gold Coin:

Weight discrepancies of more than 0.1 grams from the official specifications

Inconsistent color or luster compared to genuine specimens

Blurred or imprecise design details, especially in the coin’s lettering

Incorrect mint marks or date styles for the purported year of minting

Unusual wear patterns inconsistent with the coin’s alleged grade

Magnetic properties (gold is non-magnetic)

Prices are significantly below current market values for similar coins

Best Practices for Storage and Handling

The primary enemies of coin preservation are environmental factors such as humidity, temperature fluctuations, and air pollutants.

Store your Liberty Gold Coins in a controlled environment to combat these threats.

Ideal Conditions for Coin Storage:

Relative Humidity: Keeping relative humidity below 50% helps prevent the corrosion and tarnishing of coins.

Stable Temperature: A stable temperature around 70°F (21°C) is ideal for storing coins, as sharp fluctuations can lead to damage.

When handling Liberty Gold Coins:

Minimize Direct Contact: The oils and acids from human skin can cause long-term damage to the metal, leading to discoloration and degradation.

Handle by Edges: Always handle coins by their edges, which reduces the risk of leaving fingerprints or causing scratches on the face of the coin.

Use of Gloves: When handling coins, wear cotton, powder-free latex, or nitrile gloves. These help protect the coin’s surface from oils and dirt that can transfer from bare hands.

Mylar flips and non-plasticized polyethylene or polyester holders are recommended for individual coin storage as they don’t contain harmful chemicals that can react with the coin’s metal over time.

Avoid using PVC-based materials, as they can cause “green goo” to form on the coin’s surface, potentially causing irreversible damage.

For long-term storage of multiple coins, consider using a safe deposit box at a bank or a fireproof and waterproof home safe.

If opting for a home safe, ensure it’s securely anchored to prevent theft.

Tip: Establish a routine check, perhaps quarterly, to examine each coin for signs of toning, spotting, or other changes. This practice helps maintain the collection and keeps you familiar with the current state of your investments.

Insurance and Security for Your Coin Collection

As the value of Liberty Gold Coins continues to appreciate, ensuring adequate insurance coverage becomes increasingly important. Standard homeowners’ or renters insurance policies often limit coverage for collectibles, which may be insufficient for a significant coin collection.

However, specialized collectibles insurance offers more comprehensive protection tailored to the unique needs of numismatic investments.

These policies typically cover a broader range of perils, including theft, accidental damage, and, sometimes, market value appreciation.

When selecting an insurance provider, look for companies with experience in numismatics and a track record of fair claim settlements.

Accurate valuation is crucial for proper insurance coverage. Given the volatile nature of the coin market, regular appraisals are necessary to ensure your coverage keeps pace with your collection’s value.

Many insurers recommend annual appraisals for collections valued over $100,000 and biennial appraisals for smaller collections.

For high-value collections (over $100,000), annual appraisals are often recommended to keep insurance coverage aligned with current market values and to account for any changes in the collection.

For smaller collections, biennial appraisals (every two years) are typically suggested, as these collections may not experience as significant fluctuations in value.

For exceptional-value collections, consider storing most of your coins in bank vaults or specialized numismatic storage facilities.

These options offer superior security and often come with built-in insurance coverage.

However, weigh the benefits against the potential inconvenience of limited access to your collection.

Lastly, be discreet about your collection. Avoid publicly discussing the details or value of your Liberty Gold Coins, as this information can make you a target for theft.

Tax Considerations for Liberty Gold Coin Investments

Investing in Liberty Gold Coins can have significant tax implications, and understanding these is crucial for maximizing the benefits of your investment while remaining compliant with tax laws.

The tax treatment of these coins can be complex, as they straddle the line between collectibles and precious metals investments.

1. Capital Gains Tax on Liberty Gold Coins

In the United States, Liberty Gold Coins are generally classified as collectibles for tax purposes, regardless of their gold content.

This classification has important implications for capital gains tax. As of 2024, collectibles held for more than one year are subject to a maximum federal tax rate of 28%.

Collectibles, such as art, antiques, and certain coins, are subject to a maximum federal capital gains tax rate of 28%.

This 28% rate is higher than the long-term capital gains tax rates for most other investments, which range from 0% to 20%, depending on the taxpayer’s income level.

The 28% rate applies regardless of your ordinary income tax rate, meaning that even if you fall into a lower ordinary income tax bracket, the gains from the sale of collectibles will still be taxed at the maximum rate of 28%.

2. Reporting Requirements

Investors must report all sales of Liberty Gold Coins on their tax returns.

This includes reporting capital gains or losses on Form 8949 and Schedule D of Form 1040.

For substantial transactions, coin dealers may be required to file Form 1099-B, reporting the sale to the investor and the IRS.

For high-value collections, it’s crucial to maintain detailed records of purchases, sales, and appraisals. These records should include:

Date of purchase and sale

Purchase price and selling price

Any associated fees (e.g., dealer commissions, grading costs)

Proof of payment and receipts

Appraisal documents for insurance or estate planning purposes

Accurate record-keeping facilitates tax reporting and helps substantiate claims in case of an IRS audit.

3. Tax Strategies for Liberty Gold Coin Investors

Despite the higher tax rate on collectibles, there are strategies you can employ to optimize your tax situation:

Long-term holding: Holding coins for over a year can help you avoid the higher short-term capital gains rates.

Tax-loss harvesting: Selling coins at a loss can offset gains from other investments, potentially reducing overall tax liability. However, be aware of the wash-sale rule, which prohibits repurchasing substantially identical assets within 30 days.

Charitable donations: Donating Liberty Gold Coins to qualified charities can provide a tax deduction based on the coins’ fair market value.

Estate planning: Passing Liberty Gold Coins to heirs can provide tax advantages. The coins receive a step-up in basis to their fair market value at the time of the owner’s death, potentially reducing future capital gains tax for heirs.

Retirement account investments: Some self-directed IRAs allow investments in precious metals, including certain gold coins. However, Liberty Gold Coins are generally not eligible for inclusion in these accounts due to their classification as collectibles. Similar modern gold coins, such as American Gold Eagles, may be permissible, offering potential tax-deferred or tax-free growth.

Note: Given the complexities involved, we recommend you consult a tax professional with numismatic investment experience.

They can provide personalized advice based on your specific situation and help you develop a tax-efficient strategy for your Liberty Gold Coin investments.

Strategies for Selling Liberty Gold Coins

Selling Liberty Gold Coins requires careful planning and market awareness to maximize returns on your investment.

1. Time Your Sale

Various factors, including gold prices, numismatic trends, and overall economic conditions, influence the market for Liberty Gold Coins.

Monitoring the precious metals market and the specific numismatic market for Liberty Gold Coins is essential.

Tools like the PCGS3000® Index or the NGC Coin Explorer can provide insights into market trends for rare coins.

Seasonal patterns also influence selling opportunities.

Traditionally, the coin market sees increased activity during major numismatic conventions, such as the ANA World’s Fair of Money held each August.

2. Choose the Right Selling Venue

Each selling venue has its pros and cons:

Coin Dealers: Established dealers offer convenience and immediate payment.

Auctions: Both traditional and online auctions can achieve higher prices, especially for rare or high-grade specimens.

Online Marketplaces: Platforms like eBay have become increasingly popular for coin sales.

Peer-to-Peer Sales: Direct sales to other collectors can yield the highest returns but require more effort and carry additional risks. Online forums and social media groups dedicated to numismatics have grown significantly.

Coin Shows: These events, like the 2024 FUN Show, offer the opportunity to reach multiple potential buyers in person.

3. Prepare Your Coins for Sale

Start by having your coins professionally graded if they aren’t already.

High-quality photography is increasingly important, especially for online sales.

Consider investing in professional imaging services, which have become more accessible and affordable.

Some services now offer 360-degree video imaging, which has been shown to increase buyer confidence and final sale prices.

Then, provide detailed, accurate descriptions of your coins, including any notable features, toning, or provenance.

Transparency about any imperfections is crucial for building trust with potential buyers.

Consider obtaining a Certified Acceptance Corporation (CAC) sticker for valuable or rare specimens.

4. Negotiate and Set the Price

Research recent sales of comparable coins to establish a realistic price range.

Online price guides and auction archives can provide valuable data.

Be prepared to negotiate, especially when dealing with dealers or experienced collectors.

Understanding the current market dynamics and having a clear bottom line can help you navigate negotiations effectively.

For auction sales, set a reserve price to protect against underselling in a soft market. However, be cautious not to set the reserve too high, as this can deter potential bidders.

Online vs. Physical Dealers: Pros and Cons

Understanding these pros and cons can help you make an informed decision aligned with your investment strategy and personal comfort level.

Online Dealers

Pros

Unparalleled convenience and accessibility, allowing 24/7 browsing and purchasing

Vast inventories with a wide variety of coins to choose from

Competitive pricing due to lower overhead costs

Easy price comparison across multiple dealers

Detailed product information, high-resolution images, and customer reviews readily available

Cons

Inability to physically examine coins before purchase

Challenges in assessing subtle details that can impact value, especially for rare specimens

Potential security concerns with online transactions and shipping

Less personalized expert advice and historical context

Physical Dealers

Pros

Ability to examine coins in person before purchase

Face-to-face interactions with knowledgeable dealers providing personalized advice

Access to expert insights, market knowledge, and historical context

Opportunity to build relationships within the collecting community

Potential access to rare coins through established dealer networks

Cons

Limited to business hours and physical location

Potentially higher prices due to increased overhead costs

More limited inventory compared to online platforms

The time-consuming process of visiting multiple dealers for price comparison

The choice depends on individual preferences, investment goals, and the specific coins sought.

Many investors adopt a hybrid approach, combining the strengths of both online and physical dealers.

Conclusion

The market for these coins has shown resilience and growth, with data from 2023 and 2024 indicating increased interest among collectors and investors.

Liberty Gold Coins’ dual nature as numismatic treasures and precious metal investments provides a hedge against economic uncertainties while offering the potential for significant value appreciation.

Key takeaways for you include:

It’s important to have education and due diligence to understand Liberty Gold Coins’ nuances.

Professional grading and authentication are crucial in establishing and preserving coin value.

The need for careful consideration of storage and insurance to protect your investment.

The significance of tax planning and compliance in managing your coin portfolio.

A strategic approach is required when timing and executing sales to maximize returns.

As the numismatic market evolves, staying informed about market trends, technological advancements in authentication and trading platforms, and regulatory changes will be crucial for success in this field.

Frequently Asked Questions (FAQs)

What Makes Liberty Gold Coins a Good Investment?

Liberty Gold Coins combine intrinsic gold value with historical and numismatic significance. They offer a hedge against inflation, potential for appreciation beyond gold prices, and tangible asset diversification.

How Do I Start Collecting Liberty Gold Coins?

Begin by educating yourself about the different types and grades of Liberty Gold Coins. Start with common dates to understand the market, then gradually explore rarer specimens. Consider joining numismatic organizations for networking and education.

Can Liberty Gold Coins Increase in Value Over Time?

Yes, Liberty Gold Coins can appreciate significantly. Factors influencing value include rarity, condition, historical significance, and gold prices.

Are Liberty Gold Coins a Good Hedge Against Inflation?

Liberty Gold Coins can be an effective inflation hedge. Their gold content provides intrinsic value, while their numismatic appeal can lead to appreciation beyond inflation rates. During the 2022-2023 inflationary period, Liberty Gold Coins maintained their purchasing power, with some rare specimens significantly outperforming inflation rates.

How Often Should I Have My Liberty Gold Coins Appraised?

Regular appraisals are crucial for insurance and investment purposes. Biennial appraisals are generally sufficient for collections valued under $100,000. Annual appraisals are recommended for more valuable collections or in volatile markets.