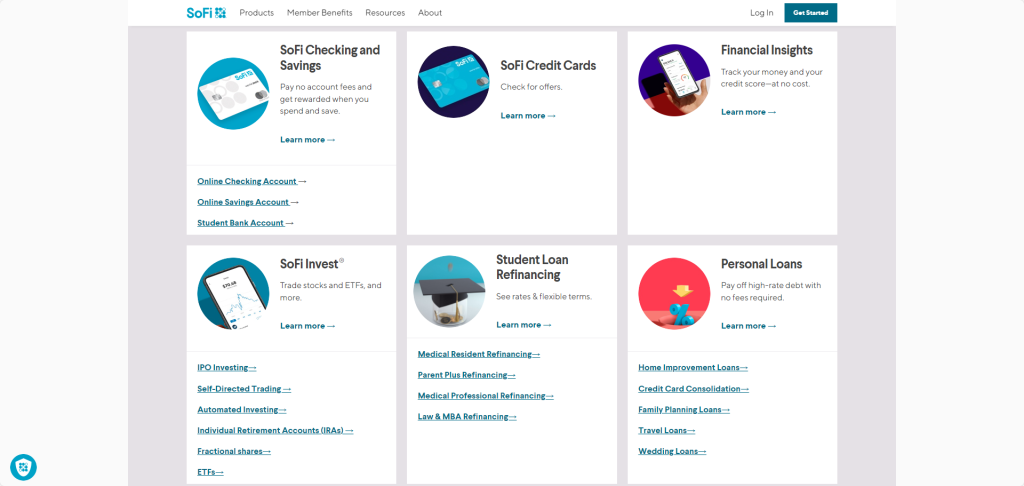

From high-yield checking and savings accounts to powerful investment platforms and personal loans, SoFi’s 2024 product lineup caters to the diverse needs of its growing member base.

I’ve carefully selected the top 5 SoFi products that stand out for their value and potential to boost your financial well-being.

Table of Contents

Product 1: SoFi Checking and Savings

SoFi Checking and Savings is a hybrid banking product that combines checking and savings accounts.

It offers a competitive interest rate of up to 4.60% APY. This is significantly above the national average of 0.45%.

To qualify for the highest APY on SoFi savings, account holders must receive direct deposits from an employer, payroll, or benefits provider via ACH.

Alternatively, you can qualify with monthly deposits of $5,000 or more.

But even without the highest APY, the SoFi Checking and Savings account still offers competitive rates starting at 0.50%.

Key features of SoFi checking and savings accounts include:

APY Range: 0.50%–4.60%

Requirement for Highest APY: Direct deposit or $5,000 or more in qualifying deposits

Minimum Deposit: $0

Withdrawal Limit: None

Monthly Service Fee: None

When opening a SoFi account, you’ll need to open both a checking and savings account together, as they’re inseparable. You can’t have one without the other.

What other advantages do SoFi Checking and Savings accounts offer?

1. No-Fee Banking: Keeping More of Your Money in Your Pocket

Bank fees can quickly erode savings. SoFi addresses this issue by offering a fee-free experience for its Checking and Savings account holders.

This account does not have monthly maintenance, overdraft, or ATM fees (within the Allpoint Network).

This structure makes SoFi an excellent choice for anyone tired of the hidden costs often associated with traditional banks.

Unlike other institutions that require you to jump through hoops to avoid fees, SoFi simplifies the process.

You don’t need to worry about maintaining a minimum balance or making a certain number of transactions to qualify for fee waivers—because there simply aren’t any fees to waive.

2. Bonuses and Automatic Savings Features

SoFi offers a sign-up bonus of up to $300 to sweeten the deal for new account holders who set up direct deposit.

This bonus structure is tiered, with eligible deposits of $1,000 to $4,999.99 within a 25-day promotional period qualifying for a bonus of up to $50 and deposits of $5,000 or more qualifying for the full $300 bonus.

Beyond bonuses, SoFi simplifies saving with features like Money Vaults and Roundup Debits. Money Vaults allow you to set aside funds for specific goals within your main savings account, such as an emergency fund, vacation, or home improvement project.

Meanwhile, Roundup Debits automatically rounds up your debit card purchases to the nearest dollar and deposits the difference into your savings vault, helping you save without even thinking about it.

Pros and Cons of SoFi Checking and Savings

Pros

Excellent interest rates (subject to meeting deposit requirements)

No ongoing fees (except for cash deposits)

Full-service financial firm offering various financial products

Automatic savings program

Access to member benefits program

Cons

$4.95 fee for depositing cash

No in-person branches

You must sign up for a SoFi checking account alongside savings

Rate and benefits depend on deposit activity

Product 2: SoFi Invest

SoFi Invest caters to novice and experienced investors.

The platform provides active and automated investing solutions and access to alternative investments and retirement accounts—all accessible through an easy-to-use app.

When you fund a new account, you get a generous sign-up bonus of up to $1,000 in stock.

SoFi Invest’s platform is built around four main investment approaches:

Active Investing: SoFi offers commission-free trading of stocks and ETFs for hands-on investors. Investors can also participate in IPOs at IPO prices and purchase fractional shares for as little as $5.

Automated Investing: This option caters to those who prefer a hands-off approach. Based on an investor’s risk tolerance and goals, SoFi creates and manages a diversified portfolio with no advisory fees.

Alternative Investments: SoFi has expanded its offerings to include access to commodities, private credit, pre-IPO unicorns, and venture capital, providing opportunities for portfolio diversification.

Retirement Accounts: Investors can choose from Traditional, Roth, and SEP IRAs, with the option for either active or automated management.

SoFi Invest accounts come with several attractive features:

No account minimums for active investing

No commissions on stock and ETF trades

There are no management fees for automated investing

$5 minimum for fractional shares

Up to $1,000 in stock when funding a new account (terms apply)

Additionally, all SoFi members have complimentary access to certified financial planners who offer personalized advice based on individual needs.

SoFi Invest also caters to various investor needs by offering:

Individual investment accounts

Joint accounts

Traditional IRAs

Roth IRAs

SEP IRAs

401(k) rollovers

Investor protection is a priority, with accounts covered by SIPC protection up to $500,000, including $250,000 for cash claims.

SoFi Invest maintains a strong reputation, as evidenced by its A+ rating from the Better Business Bureau.

While this rating does not guarantee reliability or performance, it reflects positively on the company’s customer service and business practices.

Pros and Cons of SoFi Invest

Pros

There is no account minimum for active investing

Commission-free stock, ETF, and options trades

Low fees and account minimums overall

Multiple account options, including robo-advisor and IRAs

Diverse investment options (stocks, ETFs, fractional shares, IPOs, options, alternative investments)

Complimentary access to Certified Financial Planners

Financial and estate planning features

Easy integration with other SoFi products

Cons

Lack of tax-loss harvesting

Only invests in US assets

$2,000 account minimum for margin accounts

No longer supports cryptocurrency trading

Limited options for advanced traders (e.g., no stop-loss orders for active investing)

Currently, it is only available to US residents

Product 3: SoFi Credit Card

The SoFi Unlimited 2% Credit Card is designed to help you maximize rewards with no restrictions.

You’ll earn unlimited 2% cash back on all purchases, making it a great option for travelers, shoppers, and everyday spenders. Its straightforward rewards structure and flexible redemption options make it a valuable tool for optimizing your financial strategy.

Additional perks include:

Unlimited 2% cash back rewards on all purchases

3% cash back rewards on trips booked through SoFi Travel

No annual fee

No foreign transaction fees

Flexible redemption options, including statement credit or distribution to other SoFi products

Additionally, there are no limits, caps, rotating categories, or minimum redemption amounts to track.

And beyond the cash-back rewards, cardholders enjoy other benefits that enhance the card’s value:

Zero fraud liability protection

ID theft protection

Mastercard world elite benefits, including 24/7 travel concierge, $5 monthly Lyft credits, and free 2-day shipping with Shoprunner

Cell phone protection up to $1,000

Who Should Consider the SoFi Unlimited 2% Credit Card?

This card is perfect for those with excellent credit who want an easy way to earn cash back on every purchase. Its simple rewards, travel perks, and no annual fee make it great for everyday and big purchases.

Plus, if you’re already using SoFi products, integrating your rewards is a seamless experience.

How to Apply for the SoFi Unlimited 2% Credit Card

To apply for the SoFi Unlimited 2% Credit Card, you must meet the following criteria:

Be at least 18 years old (or the legal age required by their state of residence)

Have a physical U.S. mailing address

Possess a valid Social Security number

The initial application process involves a soft credit pull, which doesn’t impact your credit score.

However, if approved, SoFi will perform a hard credit pull, which may affect the credit score.

One of the card’s key strengths is its flexible redemption options. You can redeem cash-back rewards as statement credits or apply them to other SoFi products, such as SoFi Checking & Savings, SoFi Invest, or eligible loan payments.

Product 4: SoFi Personal Loans

Rated 4.5 out of 5 by 8643 customers on TrustPilot, SoFi Personal Loans offer you a flexible solution for borrowing between $5,000 and $100,000.

With terms ranging from two to seven years, you can use these unsecured loans to consolidate debt, finance home improvements, or cover unexpected expenses.

Key features of SoFi personal loans include:

Loan amounts: $5,000 to $100,000 (higher minimums in some states)

Loan terms: 2 to 7 years (24 to 84 months)

APR range: 8.99% to 29.99% with autopay

No origination fees, late fees, or prepayment penalties

Funding as soon as the same day after approval

0.25% APR reduction for autopay enrollment

To be eligible for a SoFi personal loan, you must meet these requirements:

Minimum credit score: 650 (most successful applicants have 700 or higher)

Minimum annual income: $45,000 (average borrower income is over $100,000)

At least $1,500 in monthly free cash flow preferred

Must be a U.S. citizen or permanent resident

Must be at least 18 years old (varies by state)

SoFi also allows co-applicants but does not permit co-signers. Co-applicants must live at the same address as the primary applicant and cannot be removed from the loan.

They evaluate applicants based on their debt-to-income (DTI) ratio and free cash flow available after covering other monthly expenses.

Ideal candidates typically have at least $1,500 in free cash flow each month.

Why Choose SoFi Personal Loans?

SoFi offers competitive interest rates that save you money compared to high-interest credit cards. With rates ranging from 8.99% to 29.99%, SoFi accommodates different credit profiles.

Plus, you can unlock extra savings through various discounts, including:

0.25% rate reduction for setting up autopay

Special offers for debt consolidation

Potential discounts for SoFi checking account holders

Additionally, in an industry where fees are often the norm, SoFi eliminates common charges. This fee-free approach includes no origination fees, no late payment fees, and no prepayment penalties

Further recognizing that some borrowers may benefit from a team approach, SoFi allows joint loan applications. This feature can be helpful for:

Applicants with less-than-perfect credit

- Those looking to secure lower interest rates potentially

Couples or partners wanting to share financial responsibilities

Another advantage is that you can explore options such as loan forbearance and modified payment plans during a job loss or financial difficulty.

SoFi Personal Loans Pros and Cons

Pros

High loan amounts available

No fees (origination, late, or prepayment)

Fast funding

Prequalification with soft credit check

Co-applicants allowed

Cons

High credit score and income requirements

No co-signers permitted

Not available for education-related expenses

Product 5: SoFi Student Loan Refinancing

Another product that SoFi offers is student loan refinancing.

Refinancing your student loans with SoFi can help lower your monthly payments, secure a better interest rate, and consolidate your debt into a single, manageable payment. As a top provider in online lending, SoFi offers competitive rates, flexible terms, and a completely fee-free process.

Here’s the range of interest rates SoFi offers for student loan refinancing:

Fixed rates ranging from 5.24% to 9.99% APR

Variable rates from 6.24% to 9.99% APR

These rates include a 0.25% autopay discount, which can lead to significant savings over the life of the loan.

A standout feature of SoFi Student Loan Refinancing is its no-fee structure. There are no origination fees, prepayment penalties, or late fees, allowing you to manage your debt without hidden costs. This fee-free approach lets you focus solely on repaying your loan.

SoFi also provides flexible repayment terms, ranging from 5 to 20 years, giving you options that fit your financial goals.

Who Should Consider Refinancing with SoFi?

SoFi Student Loan Refinancing is an excellent option for borrowers who:

Have high-interest student loans and want to lower their rates.

Prefer a fee-free refinancing experience.

Seek flexible repayment terms that fit their budget.

Want to simplify multiple loans into one payment.

Have good to excellent credit and are likely to qualify for competitive rates.

Refinancing federal student loans with SoFi converts them into private loans, which means you’ll lose access to federal benefits like income-driven repayment plans and public service loan forgiveness. Be sure to carefully consider these factors before making a decision to refinance.

Pros and Cons of SoFi Student Loan Refinancing

Pros

SoFi offers some of the best rates, especially for borrowers with excellent credit.

You can refinance without origination fees, prepayment penalties, or late fees.

You can choose from a variety of terms to suit your financial needs.

Get started quickly with a simple online application.

Good reputation and trust: SoFi has helped over 475,000 members refinance their student loans, refinancing over $41 billion.

Cons

A hard credit pull is required during the application process.

Refinancing federal loans with SoFi means losing access to federal benefits.

More SoFi Products

In addition to the five key products we’ve covered, SoFi provides other financial tools to help you manage and grow your wealth effectively:

1. Financial Insights

SoFi’s Financial Insights tool helps you track your spending, set savings goals, and monitor your financial health. It provides personalized tips and recommendations to keep you on track and optimize your financial decisions.

This tool allows you to link all your financial accounts, including checking, savings, investment, retirement accounts, credit cards, student loans, mortgages, and other liabilities. This gives you a comprehensive view of your entire net worth in one place.

For accounts that can’t be linked automatically, you can manually add assets like a car or home, ensuring you have a complete picture of your financial health.

2. Mortgages

SoFi offers a variety of mortgage options, including 10-year, 15-year, 20-year, and 30-year fixed mortgages.

With competitive rates and flexible terms, SoFi makes it easier to find the right mortgage for your situation.

As of 2024, SoFi’s mortgage rates include:

10-year fixed: 5.250% rate (5.881% APR)

15-year fixed: 5.250% rate (5.696% APR)

20-year fixed: 5.750% rate (6.127% APR)

30-year fixed: 6.000% rate (6.281% APR)

To determine your best mortgage, you can start by evaluating your down payment, interest rate, credit score, and monthly payments.

Use SoFi’s Mortgage Calculator to explore different scenarios and find the loan that best suits your budget.

3. Private Student Loans

When federal student loans don’t cover all your educational expenses, SoFi’s private student loans can fill the gap.

You can use these loans for tuition, fees, housing, books, and supplies.

SoFi offers fixed and variable interest rates, with repayment terms ranging from 5 to 20 years.

While private student loans require a credit check, a cosigner can help you qualify for better rates and terms.

With competitive APRs and flexible repayment options, SoFi’s private student loans are a solid choice for financing your education.

Take Advantage of SoFi’s Comprehensive Financial Ecosystem

SoFi’s financial products give you the opportunity to streamline your finances.

Strategically utilizing these offerings can potentially optimize your financial life in several ways:

With SoFi Checking and Savings, you can earn high-yield interest rates while avoiding common banking fees. This could significantly boost your savings over time.

SoFi Invest provides active and automated investing options, allowing you to build a portfolio that aligns with your financial goals and risk tolerance.

The SoFi Unlimited 2% Credit Card offers straightforward cash back on all purchases, potentially putting more money back in your pocket with each transaction.

SoFi Personal Loans offer competitive rates and flexible terms, which could help you manage debt or fund significant purchases more efficiently.

If you have existing student loans, SoFi’s Student Loan Refinancing could lower your interest rate or monthly payments, streamlining your debt repayment.

Beyond these core products, SoFi’s additional offerings, such as mortgages, private student loans, and financial planning tools, can help you address other aspects of your financial life.

The interconnected nature of SoFi’s ecosystem means using multiple products could lead to additional benefits or discounts.

For those who align with SoFi’s target demographic — individuals with good to excellent credit and stable incomes — taking advantage of this financial ecosystem could lead to more streamlined money management and potentially better financial outcomes.

Remember to:

Compare SoFi’s offerings with other options in the market

Read the terms and conditions carefully for each product

Consider the long-term implications of your choices, especially for products like student loan refinancing

Frequently Asked Questions

What credit score do I need to qualify for SoFi personal loans?

You need a minimum credit score of 680 to qualify for a SoFi personal loan.

What are the current interest rates for SoFi student loan refinancing?

The fixed rates start at 5.24% APR with autopay, while variable rates range from 6.24% to 9.99% APR (with a 0.25% autopay discount).

Is there a minimum balance requirement for SoFi Checking and Savings?

No, there’s no minimum balance requirement for SoFi Checking and Savings accounts. However, you need to make monthly deposits of at least $500 to earn higher interest rates and cashback rewards.

What are the interest rates and fees for SoFi personal loans?

Fixed rates range from 8.99% to 29.99% APR, which include a 0.25% autopay discount and a 0.25% direct deposit discount.

Can I access my SoFi accounts and products through a mobile app?

Yes, you can access your SoFi accounts and products through the SoFi mobile app. The app allows you to manage money, invest, check rates, apply for loans, and more.

What happens if I lose my job? Are there any protections for SoFi loan borrowers?

SoFi offers an Unemployment Protection Program for borrowers who lose their jobs through no fault of their own. You can apply for this program if you’re eligible for unemployment compensation. Once approved, SoFi can place your loan payments into forbearance for up to three months at a time, with a maximum of 12 months available over the life of the loan. You’ll need to reapply every three months if you require continued assistance. SoFi will also work with you to modify your monthly loan payments during this period, providing flexibility as you navigate your job search.

How does SoFi’s automated investing compare to other robo-advisors?

SoFi charges no annual management fees and has a minimum investment requirement of just $1, a significant advantage over many competitors. It also offers a range of investment accounts, including traditional IRAs, Roth IRAs, and SEP IRAs. The platform provides automatic rebalancing and goal-based planning.